When Banks Beat, Crypto Heats, and Tariffs Hit.

If you invest in financials or banking or want to know what’s going on in the space, this is the place for you.

“Victaurs puts out more content than I think can reasonably come from any single subscription. Add to this that he is right considerably more often than not, and this is a subscription that you would be remiss to not immediately sign up for.”

And basd on the private chat I think the people in this network are some of the sharpest, most attuned, and growth oriented I’ve seen. Always engaged, always productive, and always looking to improve. I hope it stays this way forever.

One last update, August 1 pricing will be going up. From $469 a year or $43/month (a 10% discount for annual subs) to $598 a year or $58/month (a 15% discount for annual subs). Why? At least right now, we are one of the most prolific content creators of signal not noise, we are on a pretty outstanding run in fins, and because it’s the right time. If you’re on the fence, time to lock in. We’d love to have you.

But now onto the show …

Beats By Banks?

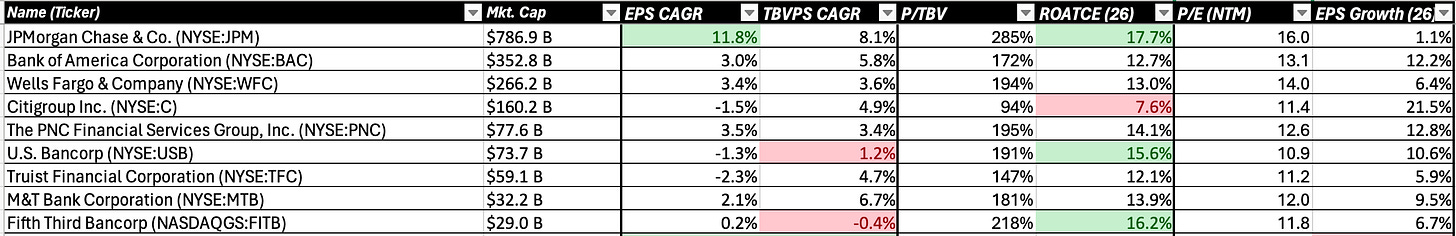

Yes. They’re coming. If you’ve been around you know we’ve been all over the big bank rally this year. The set-up was there if you knew what to look for and the sector has re-rated nicely. Regulatory relief? Check. Steeper yield curve? Check. Benign credit? Check. As we head into earnings, it looks like a nother strong quarter for the group. I can’t say that it’s going to be massive beat tie, but the tone shift is changing. It’s inflecting. And when you look at some of the out year estimates, you can see some names that are going to be growing at a time when other sectors are slowing. Along those lines, I’m going to be releasing a screen this week for the bank investors. It’ll combine longer term EPS & TBVPS CAGR rankings, current P/TBV valuations & ‘26 ROATCE estimates, as well as forward P/E ratios with ‘26 estimated EPS growth. Right now I have it for the top 180 or 190 banks. WAL and BPOP have some out year EPS growth that is becoming too attractive to pass up. I also am starting to get bearish on JPM. And those that follow along know I’m playing the broadening out from bigs into regionals. More on that to come …