This Week In Banks

DST, The Panic of 1907, Winners, Losers, Meh&A, Investment Banks, and Why You Missed NBN

November 2nd an infamous day for humans this year and in banking history.

For banking, because it’s the day J.P. Morgan locked people in a room to bail out the U.S. Banking system in 1907 (which at the time didn’t have a Fed). More on that later.

For humans, because tomorrow is daylight savings time.

Did you know the most successful marketing campaign in history wasn't created by an ad agency. It was dreamed up by governments during World War I, and we're still buying it today. I'm talking about Daylight Saving Time – the twice-yearly ritual that makes everyone show up an hour late (or early) to everything. And all of us (except Arizona & Hawaii) will “fall back” tomorrow 11/3. So, I wanted to share a little history.

Germany, with characteristic efficiency, launched this temporal experiment on May 1, 1916. Their pitch was brilliant in its simplicity: move the clocks forward, save fuel for the war effort. Like a viral TikTok challenge, other European nations quickly jumped on the bandwagon.

The United States, never one to miss a trend, made it official on March 19, 1918. The Standard Time Act promised to save energy by extending daylight hours and reducing artificial lighting needs. It was referred to as the "One Weird Trick" of its day, and people bought it hook, line, and sinker.

Well, not everyone. Farmers – who actually had to deal with reality rather than clock-watching – pointed out that cows and crops don't carry pocket watches. But urban dwellers loved it. After all, who doesn't want more daylight after a long day at the factory?

The practice went into hibernation after World War I ended in 1919, only to make a comeback during World War II. FDR actually implemented year-round daylight savings time in February of 1942 calling it “War Time”, with the goal being to save fuel and resources. It was actually repealed in 1945 when the war ended and in 1966 LBJ signed into law the Uniform Time Act to patch over the hodge podge of local time changes that occurred.

Today, over 70 countries still participate in this mass delusion. But here's what the research actually shows:

Studies find it disrupts sleep patterns long after the switch

It increases the risk of heart attacks

It increases the odds of car accidents and work accidents

Even "morning people" and "night owls" suffer equally from the transition

It messes with circadian rhythms which can cause mood disorders, cognitive impairment, memory loss, and even cause metabolic issues

All of this from a war time method to conserve energy.

And yet despite this, we soldier on, pretending it's perfectly normal to have our microwaves display the wrong time for weeks because we can't be bothered to find the manual.

The irony? The same nation that gave us this temporal torture – Germany – now leads the movement to abolish it in Europe. Perhaps they finally realized that efficiency doesn't require making everyone tired and cranky twice a year.

What does this mean for banks? I don’t know, but it’s fun to think about. Maybe the message is we’re all about to be crankier so be on the lookout.

The Biggest Losers on the Week:

This was pretty clearly HMST and FSUN. HomeStreet's CEO announced a backup plan if their acquisition by FirstSun falls through, following regulators blocking the deal. The plan involves selling $800 million in multifamily loans to return to profitability by Q1 2025. While HomeStreet cannot actively seek other buyers until January 2025 under the current merger agreement, they can consider superior offers if approached. The news of the blocked merger caused HomeStreet's stock to drop over 30% in intraday trading. What happened was that HMST and FSUN tried to play a bit of regulatory musical chairs, shifting from one regulator (who required CRE concentrations to be sub 300%) to another (who said they’d maybe be okay with 350% CRE concentrations). But regulators talk, and my sense is they weren’t happy with the banks trying to play switcheroo. But they still have a lot of wood to chop. HMST currently has about 600% of CRE to RBC and the loan sale only brings them down to 500%. I would expect someone else to swoop in here …

The Biggest Winners on the Week:

The pride of Tom Callahan’s Sandusky Ohio CIVB posted a blowout quarter. While most banks are doing the interest rate shuffle, Civista Bancshares just performed a masterclass in balance sheet choreography. Net income was up 18% from last quarter to $8.4 million, while the net interest margin expanded 7 basis points to 3.16%. The real showstopper? They snagged $100 million in state deposits at a bargain-basement 89 basis points, while cleverly refinancing $200 million in expensive brokered CDs from 5.58% to 4.32%. When discussing their savvy deposit win ($100M at 0.89%), management quipped "even a couple of dumb guys from Ohio thought that was a pretty good trade." Add in $246 million in total deposit growth and a disciplined approach to loan pricing that's kept credit quality pristine, and you've got a performance that would make even the most hardened banking analyst applaud.

Their folksy transparency extends to their approach to their 600% CRE concentration - while others might dodge it, they note they "get no pushback from regulators" while acknowledging it might weigh on their stock price. They're transitioning from a tax refund processing relationship with the calm confidence of a bank that sees opportunity in chaos - particularly in stealing deposits from larger banks, noting "community banks should benefit because we're the ones lending you the money." They've filed a $200M shelf offering with "no immediate plans" (wink, wink), are preparing for but not betting on a mortgage refinance boom and are cutting costs while maintaining their identity as a "relationship bank, not a transaction bank." It's a masterclass in how to manage through banking turbulence while keeping your sense of humor - and your discipline - intact. Great work to the entire team.

I would love it if they dropped some Tommy Boy quotes. If you’re listening, maybe next time?

M&A (Meh&A) Continues Rolling On

Here's a banking deal that won't shake Wall Street but might just reshape Pennsylvania's financial landscape. Mid Penn, the Harrisburg powerhouse ($5.5B in assets), is absorbing William Penn ($812M) in a $127 million all-stock deal that screams "efficiency" more than "excitement." I call it Meh & A.

The numbers tell the story: Mid Penn's offering 0.4260 shares for each William Penn share - a polite 6% premium that values the target at 125% of tangible book. For their trouble, Mid Penn gets $465M in loans, $630M in deposits, and 12 branches scattered across Pennsylvania and New Jersey like well-placed chess pieces. The result? A $6.3B community banking contender with nearly $5B in loans.

The deal makers promise immediate EPS accretion, though at 10x forwards, Mid Penn isn't exactly paying with a premium currency. The real story here is likely buried in the cost-save projections, as "revenue synergies" weren't exactly highlighted in bold. Rest assured investors, there will be no look back to see if the promises were kept. And there's the usual $4.9M break-up fee, and three investment bankers getting in on the deal in some form (Stephens, KBW, and Piper Sandler).

Speaking of Investment Banks

Investment banks have been on an absolute tear this year, outpacing the regional banking ETF KRE and the Capital markets ETF KCE.

PIPR delivered powerful Q3 results with revenues hitting $352M (+15% YoY) and an 18.4% operating margin. Advisory revenues jumped 22% to $188M with 71 completed transactions, while six of seven industry verticals showed major growth. The firm's PE strategy paid off significantly, with financial sponsors driving over half of the year-over-year growth in Corporate Investment Banking revenues.

The Financial Services Group demonstrated exceptional performance, successfully executing capital raises across depository, real estate, and insurance sectors. Most impressively, their debt advisory team raised over $4.2B through Q3 2024, with growing success in PE client relationships. The group's expertise in structuring creative solutions without using underwriting capital has led to significant repeat business from financial sponsors.

Management struck an unmistakably confident tone throughout the call, with CEO Chad Abraham speaking particularly assertively about October's performance and Q4 outlook. The executive team's language choices - heavy on terms like "strong," "significant," and "outstanding" with minimal hedging - suggest genuine optimism about their strategic direction and market position, especially regarding PE relationships and market share gains.

I don’t know why but having run up this much and trading at such high forward premiums, this feels like a decent short. Investment bank stocks have surged as Trump's odds of winning have increased, driven by expectations of a more favorable regulatory environment, lower corporate taxes, and stronger economic growth. People are mega bullish on the group and for me (no position yet) it feels like Murphy’s Law could derail valuations in a lot of ways even if Trump wins.

Northeast Bank Crushes, Again.

Oh NBN, the private credit fund masquerading as a bank. They basically do every “non-core” thing a bank could. Originate outside their footprint? Check. Purchase loans in size? Check. But Northeast Bank delivered another standout quarter with three key highlights: record non-PPP net income of $17.1M, their second-highest loan production ever at $942M ($733M purchased, $209M originated), and strong asset quality with improved allowance coverage to 1.25% and minimal charge-offs at 20 basis points.

Management projected continued momentum, focusing on their rapidly growing SBA program which completed 766 loans for $82.4M in Q3. They indicated strong potential for additional loan pool purchases, noting historically high activity from loan sale advisors. Their capital strategy includes utilizing remaining ATM capacity ($23M) with openness to expansion, while maintaining comfort with their higher CRE concentration given their risk management expertise.

The executive team's communication was notably confident and transparent, with CEO Rick Wayne speaking assertively about their performance and strategy. Management struck a balanced tone when discussing future opportunities - optimistic but measured, backing statements with detailed metrics and frank discussion of both opportunities and challenges. Their willingness to provide granular detail and direct answers suggested genuine confidence in their business model.

Why Did You Miss NBN?

While the investment community clings to century-old banking principles - favoring institutions that dot every corner with marble-floored branches and boast about their "relationship banking" - a quiet revolution has been taking place in Portland, Maine. Northeast Bank, shunned by traditionalists for its "unconventional" approach of purchasing loans nationally and focusing on efficiency over edifice, delivered a stunning 60% return to shareholder YTD and 32% annualized over the past 10 years. The market's stubborn devotion to convention has once again proven costly to those who worship at the altar of "that's how it's always been done" in banking.

The numbers tell a story that should make every banking analyst question their assumptions: Northeast's 32% annualized return didn't just edge out banking giant First Citizens (31.55%), it dwarfed JP Morgan's 15% and made First Long Island's -7% look positively antiquated. This is particularly ironic given that First Long Island - the darling of traditional banking - once commanded a 200% premium to tangible book value simply for following the old playbook. The market's willingness to pay double for familiarity while discounting innovation reveals a profound misunderstanding of value creation in modern banking.

Perhaps the most telling aspect of this story is how predictable it was for those willing to look beyond industry conventions. Northeast's consistent record of compounding tangible book value, revenue per share, and earnings per share above peers wasn't a secret - it was simply ignored by those who couldn't see past their own preconceptions. Bruce Lee said 'empty your cup so it may be filled.' Wall Street's cup is so full of traditional banking wisdom, they missed Northeast Bank's 60% return. Sometimes the best banking investment is the one that makes old bankers uncomfortable.

Growth Scores?

In June, I shared an analysis of banking's true growth champions - not the ones with the shiniest branches, but those consistently compounding tangible book value, earnings, and revenue per share. It's the kind of analysis that makes traditional bank investors squirm because it challenges everything, they think they know about "quality" or “core” banking.

While the market obsessed over branch networks and "relationship banking," Northeast Bank quietly outperformed banking giants by focusing on metrics that actually matter. This isn't just about one bank's success - it's about a fundamental misunderstanding of value creation in modern banking that's costing serious investors real money.

Yes, you need to watch for the occasional SVB-style implosion. But growing TBVPS, EPS, and RPS isn't just about aggressive lending - it's about having a superior business model that the market hasn't yet appreciated. And to some extent, this shows that management is serious about growing shareholder value, brick by brick.

For serious bank investors - the kind who care more about returns than conventional wisdom - my June analysis deserves a careful read. Not because it will give you a simple list of stocks to buy, but because it will challenge everything you think you know about banking success. It will open your eyes to banks that you may not have known about before. And it will make you realize that all the “core banking” stuff is nice to have, but what really drives shareholder value is growth. I’ll be updating this soon for this quarters numbers, stay tuned.

On This Day in Banking History …

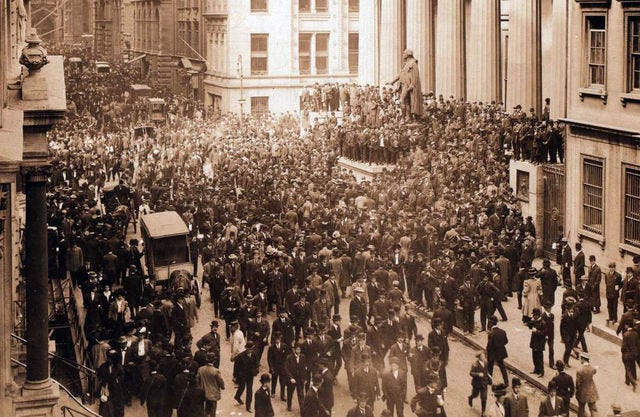

To close things out, some banking history. The Bank Panic of 1907 was a pivotal moment in U.S. financial history. It all began in October 1907 when two minor speculators, F. Augustus Heinze and Charles W. Morse, attempted to corner the market on United Copper Company stock. Their plan failed spectacularly, leading to massive losses and triggering a run on the banks associated with them. Even back then, people lived and died on over leverage. And this panic quickly spread to other banks and trust companies, causing widespread financial instability. This was the OG of “banking in turmoil” and if there was CNBC it would’ve had about 12 red sirens on the screen. X doomers back in the day would’ve had an absolute blast.

Enter the man, J.P. Morgan, the legendary financier, stepping in to save the day. On November 2nd in 1907 he locked over 40 bankers in his library and forced them to come up with solutions to avert the crisis. This isn’t a figure of speech; he literally locked the door behind them. To get the deal done, Morgan personally pledged large sums of his own money and convinced other New York bankers to do the same, effectively bailing out the financial system. The intervention during the Panic of 1907 highlighted the limitations of the U.S. Independent Treasury system, which managed the nation's money supply but couldn't inject sufficient liquidity back into the market. The Independent Treasury system, established in 1846, was designed to hold government funds and manage the nation's money supply without relying on private banks. However, it lacked the mechanisms to provide emergency liquidity during financial crises.

J.P. Morgan didn’t want to have to foot the bill for the next banking crisis, so enter the plan for a central authority. The closed-door meeting on November 2nd, was the literal spark for the creation of the Federal Reserve. Two years of research would lead to a secretive meeting held at Jekyll Island, Georgia, in November 1910. Key figures involved were Senator Nelson Aldrich, a Republican from Rhode Island and head of the National Monetary Commission; A. Piatt Andrew, Assistant Secretary of the Treasury; Henry Davison, a senior partner at J.P. Morgan & Co.; Arthur Shelton, Secretary of the National Monetary Commission; Frank Vanderlip, President of the National City Bank of New York; and Paul Warburg, a German-born banker and partner at Kuhn, Loeb & Co. These men met in secret to draft a plan to reform the nation's banking system, which eventually laid the foundation for the Federal Reserve System.

Conspiracy theories (or facts?) point out that the meeting was a clandestine effort by a small group of wealthy bankers to create a central banking system that would benefit their interests at the expense of the public. The theory posits that the Federal Reserve was designed to consolidate financial power and control over the economy. Whether true or not, the Federal Reserve Act was signed into law on December 23 in 1913.

Yet another World War era creation wreaking havoc with humans today!

Until next time,

Victaurs

Talk to me about MBIN.. One of the big losers this week and has a couple people shorting it.. I thought they a great pipeline for multi family loans with highly scrutinized sponsors