The 16x FCF Mirage: Should You Buy Uber?

Deeper analysis into Free Cash Flow and Uber's growth premium. Quantifying the AV and cyclical risk by modeling five future outcomes. And showing you the real bet being made on Uber's stock.

I read a tweet on X claiming Uber was ‘dirt cheap’ at just 16x Free Cash Flow (FCF). It seemed too clean to be right and reminded me of the days when Buffett bought Apple at 10x FCF in 2016. The Abe Lincoln internet joke applies here: if a number on the web looks too good to be true, it usually is. So I retweeted it, listened, and then ran the numbers myself. And while 16x FCF is a widely accepted headline figure, it crumbles the moment you examine what sits inside that cash flow.

Uber has become a strong cash generator; that is true. But the idea that it trades at 16x FCF is economically misleading. A quick run through the numbers shows Uber is closer to 42x once you strip away what accounting treats as free cash but shareholders cannot actually use. An investor’s job is to look beneath the surface and understand where the real, deployable cash is coming from.

From 16x FCF to a 42x Reality

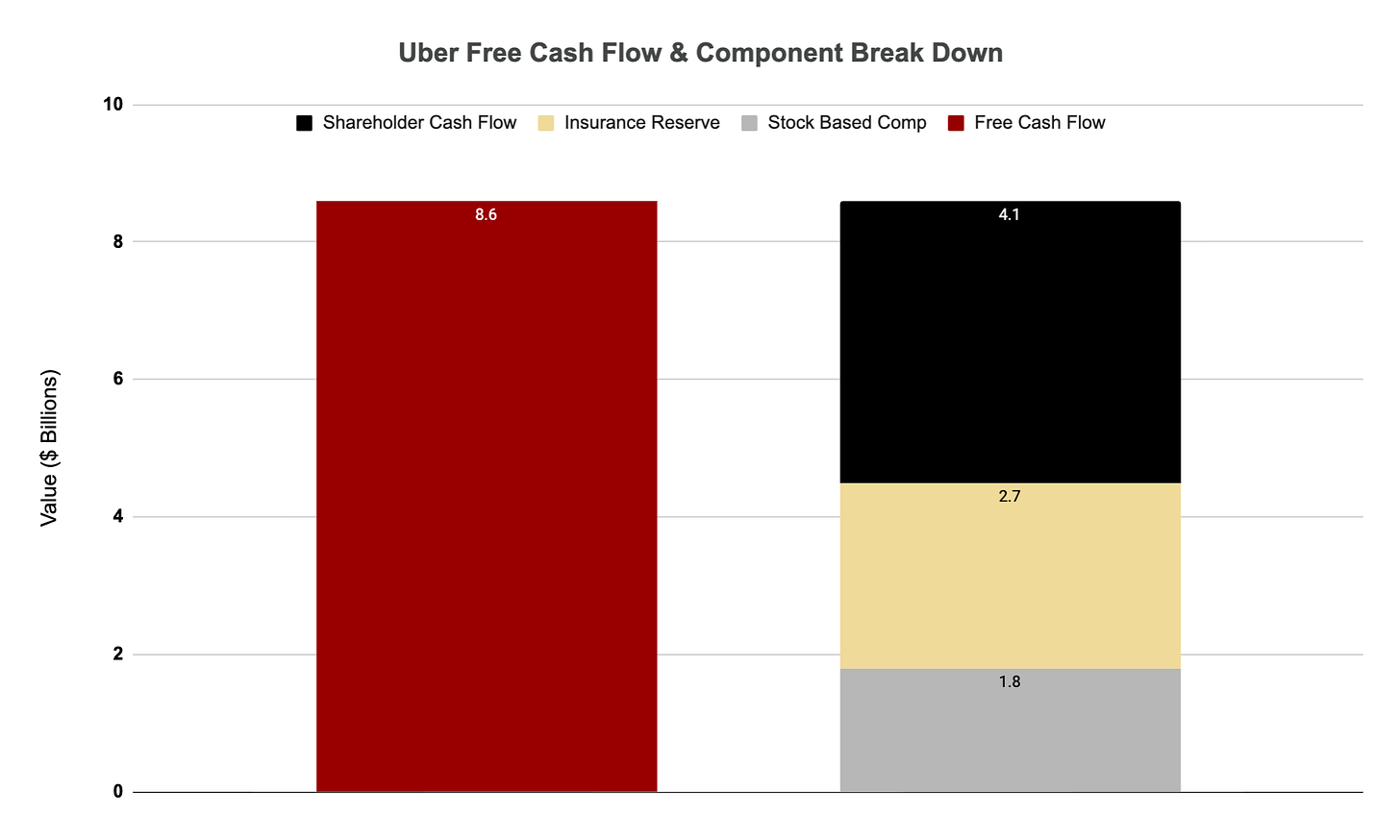

The biggest analytical mistake is confusing the cash flow accountants report as FCF with Shareholder Cash Flow (SCF). This valuation is a case where the 16x multiple is technically correct, but it is analytically misleading. It ignores two major flaws: the real cost of dilution via Stock Based Comp (SBC), and a massive pile of cash that is legally trapped via (Insurance Reserves).

Start with the insurance reserve float. Uber manages its own captive insurance, which lowers long-run insurance costs, but as the business grows, the required reserves grow too. That reserve increase shows up as operating cash flow even though it isn’t cash available to owners. Roughly $2.7 billion of Uber’s TTM Q3 OCF came from reserve growth. Removing it takes the company from 16x to roughly 29x FCF.

Next is SBC. It is added back to cash flow because it is non-cash, but for shareholders it is a real cost because it dilutes ownership. Treating SBC as an expense removes another $1.8 billion from cash flow. That leaves about $4.1 billion in true SCF that can actually be used. $4.1 billion of SCF vs. $4.5 of adjustments that can’t be utilized.

So now, divide Uber’s $174 billion market cap by that SCF, and you get roughly 42x, a premium multiple more in line with the Mag 7 than with a supposedly ‘cheap’ compounder at ‘16x FCF’.

The Market Pays a Big Premium Because of Growth

There’s an old, reliable adage that frustrates value investors: buy accelerating top lines. Uber is the perfect example. Revenue growth is the ultimate signal of momentum, and Uber has delivered: In 2023, revenue grew 17%, in 2024 it accelerated to 18%, and consensus for 2025 is for growth to hit 18-20% or so beyond.

This consistent, large-scale top line acceleration is one fundamental reason the stock has rerated so violently, up about 320% since the 2022 lows. The market is willing to pay today’s premium because the core business is absolutely firing and the economy seems good, if not great.

Under the hood from Q3’s report, total trips grew 22% year over year, and total Gross Bookings grew 21%. What really matters for Uber investor though is the network effect: users active across both Mobility and Delivery spend 3x more and stay 35% longer. The model is to get people in on rides and begin to take more of their mind & wallet share across delivery. Furthermore, Uber’s Take Rate has been steadily increasing, proving the company is using its scale to improve its profitability faster than its revenue grows. For context take rates (Revenue/Gross Bookings) in Mobility sit just above 30% and just below 20% for Delivery.

The big picture, despite my critique of FCF vs. SCF, is that not only is top line growing, so is SCF. This at the core of any bull’s argument and below you can see it swung from $803 million burn in 2023 to $4.1 billion today, an 81% growth rate. And looking below, what else do you notice?