So You Missed Nubank at $5?

Don’t Miss What’s Coming for StoneCo and PagSeguro in Brazil. A vibes dive, looking at PIX, the competitive landscape, valuations, and ways to play it.

I missed it too.

Watched Nubank trade at $5. Scrolled past it more times than I’d like to admit. Told myself it was “too early,” “too consumer,” “too crowded.” Then it hit $8, and that’s when I finally stepped in.

Was I early? Not even close. But I wasn’t late either. That entry almost doubled, and I trimmed two-thirds of the position at $15 when flows reversed, and the dollar started ripping higher. That’s how this game works: you don’t always nail the bottom, but you don’t need to if the story is real.

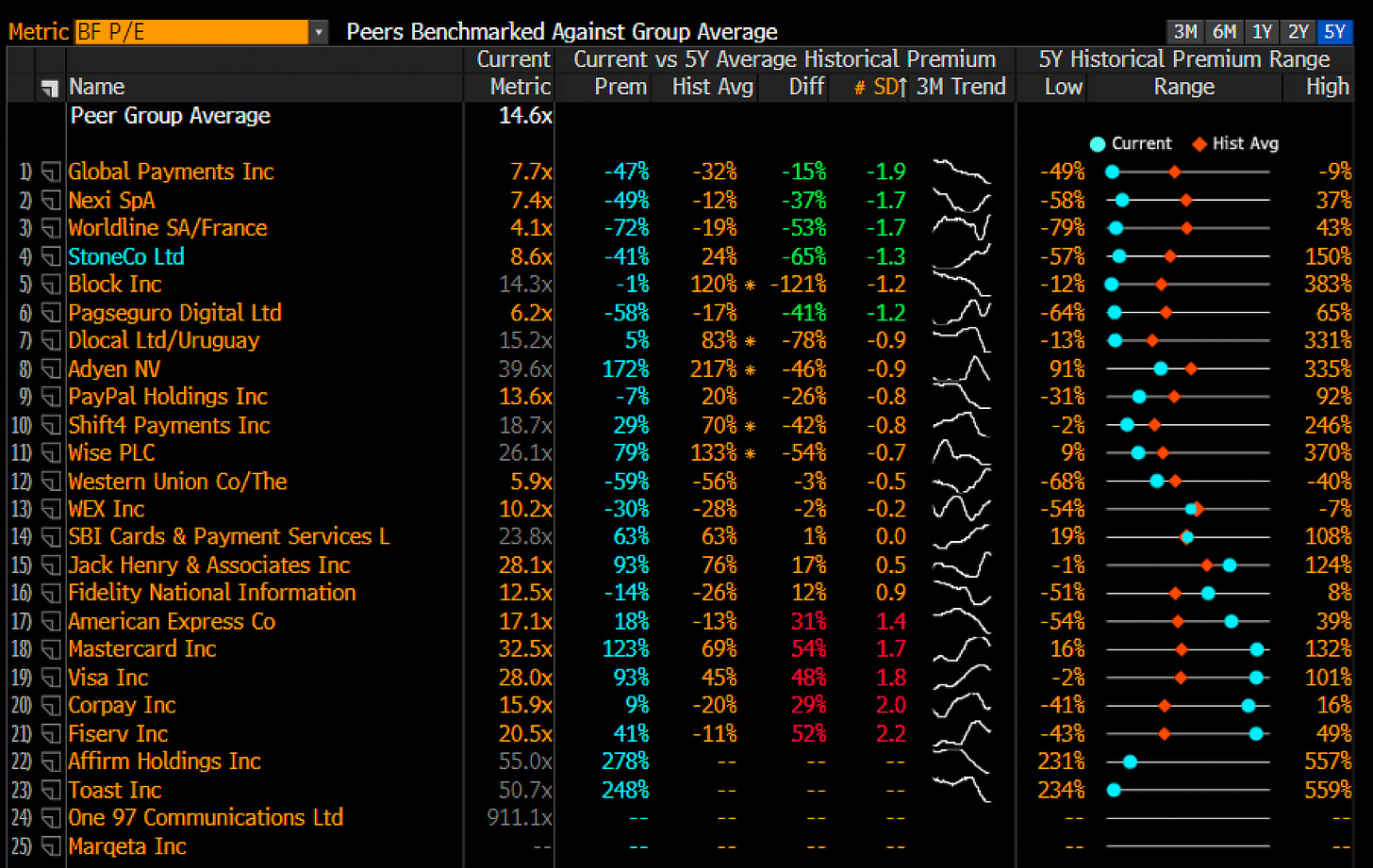

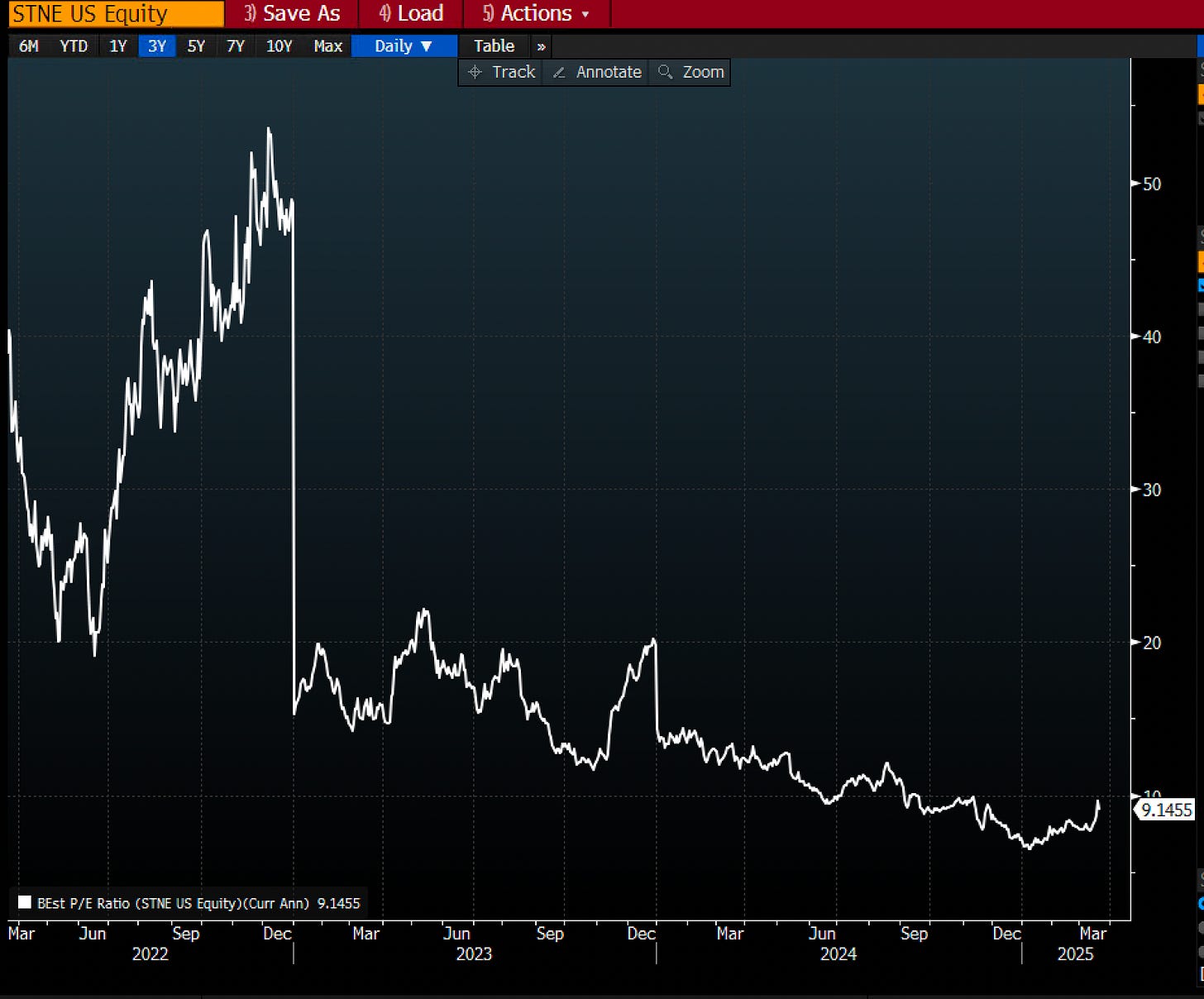

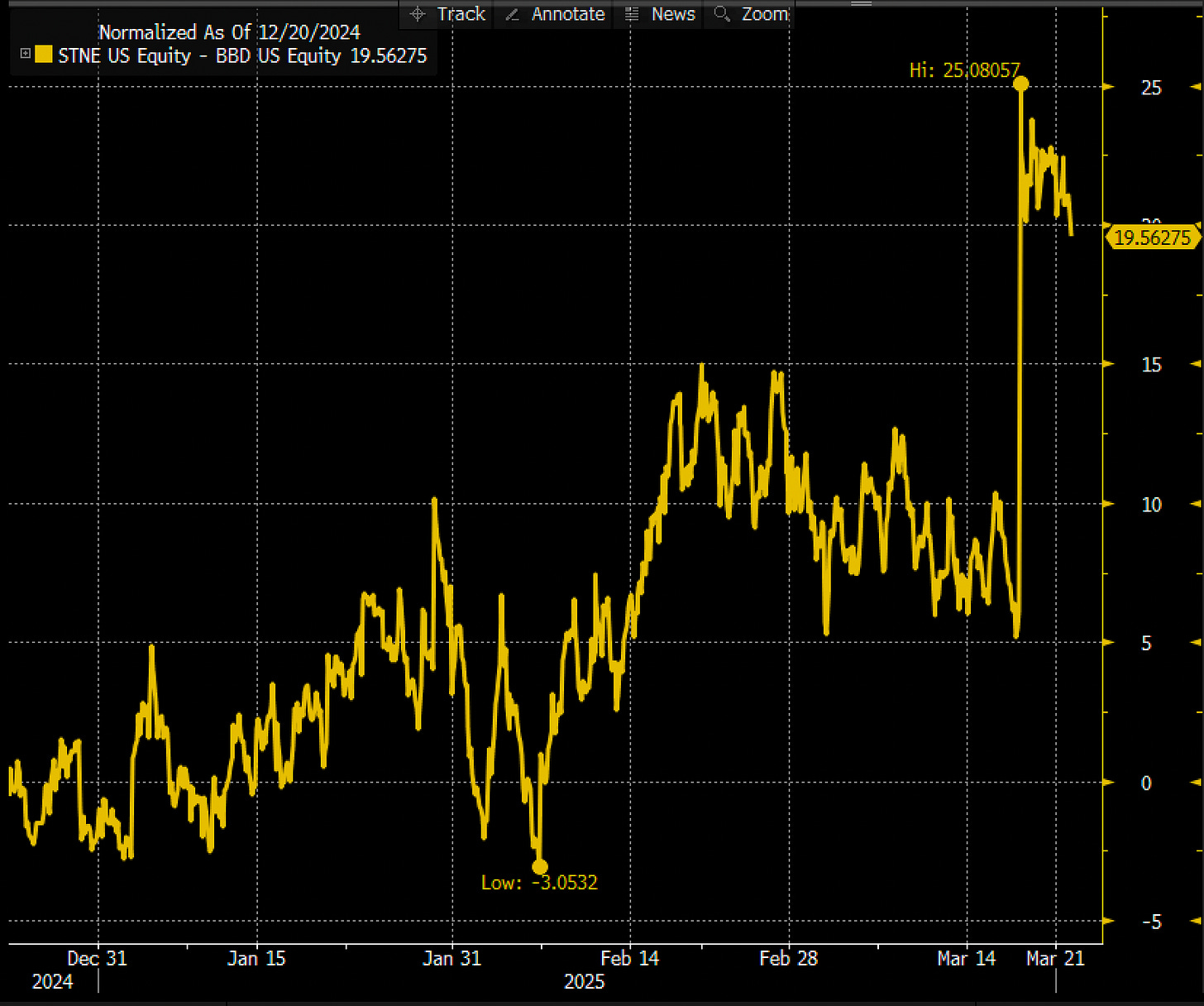

And right now? I’m seeing that same setup again, except this time it’s hidden in plain sight under two bruised, ignored, and wildly mispriced names: StoneCo and PagSeguro. Both stocks are down 30% to 40% over the past year. Both are trading at 5–7x earnings. And both still have real customers, real margins, and real businesses that are being priced as they’ve already flatlined.

They haven’t.

This is not another “innovation will save us” pitch. This is a rerating setup. A sentiment washout. A place where macro headwinds collided with washed-out flows, creating the exact type of asymmetry you want in emerging markets.

Brazil is unloved.

Investors are scared of Lula. Inflation worries are real. The real has bled out. SELIC refuses to break lower. And global capital is busy chasing other shiny objects, Europe, China, AI, crypto, whatever’s hot this week.

But underneath the apathy, two companies, PagSeguro and StoneCo, are still showing growth, expanding their platforms, and returning capital. The disconnect between fundamentals and valuation is the entire opportunity.

These setups don’t come often. When they do, you need to understand them before the tourists show up.

If you like following deep-dive emerging-market setups like this, subscribe here.

PagSeguro: The Scrappy Original Reinventing Itself

PagSeguro’s story starts with a blitz.

They went after the long tail, millions of micro-merchants across Brazil who were sick of cash, sick of slow settlement, and sick of legacy banks ignoring them. The playbook was simple: cheap card readers + a nearly free digital bank (PagBank) = hypergrowth.

It worked.

They onboarded millions. Payment volume exploded. PagBank grew into one of the most downloaded financial apps in the country. In 2024 alone, PagBank added over 4 million new clients, a 40% year-over-year jump. That’s not noise. That’s franchise value.

But scale draws blood.

Competitors flooded in. Take rates tightened. Margins compressed. Growth-at-all-costs was no longer sustainable. So PagSeguro pivoted. Hard.

The Shift to Larger Merchants

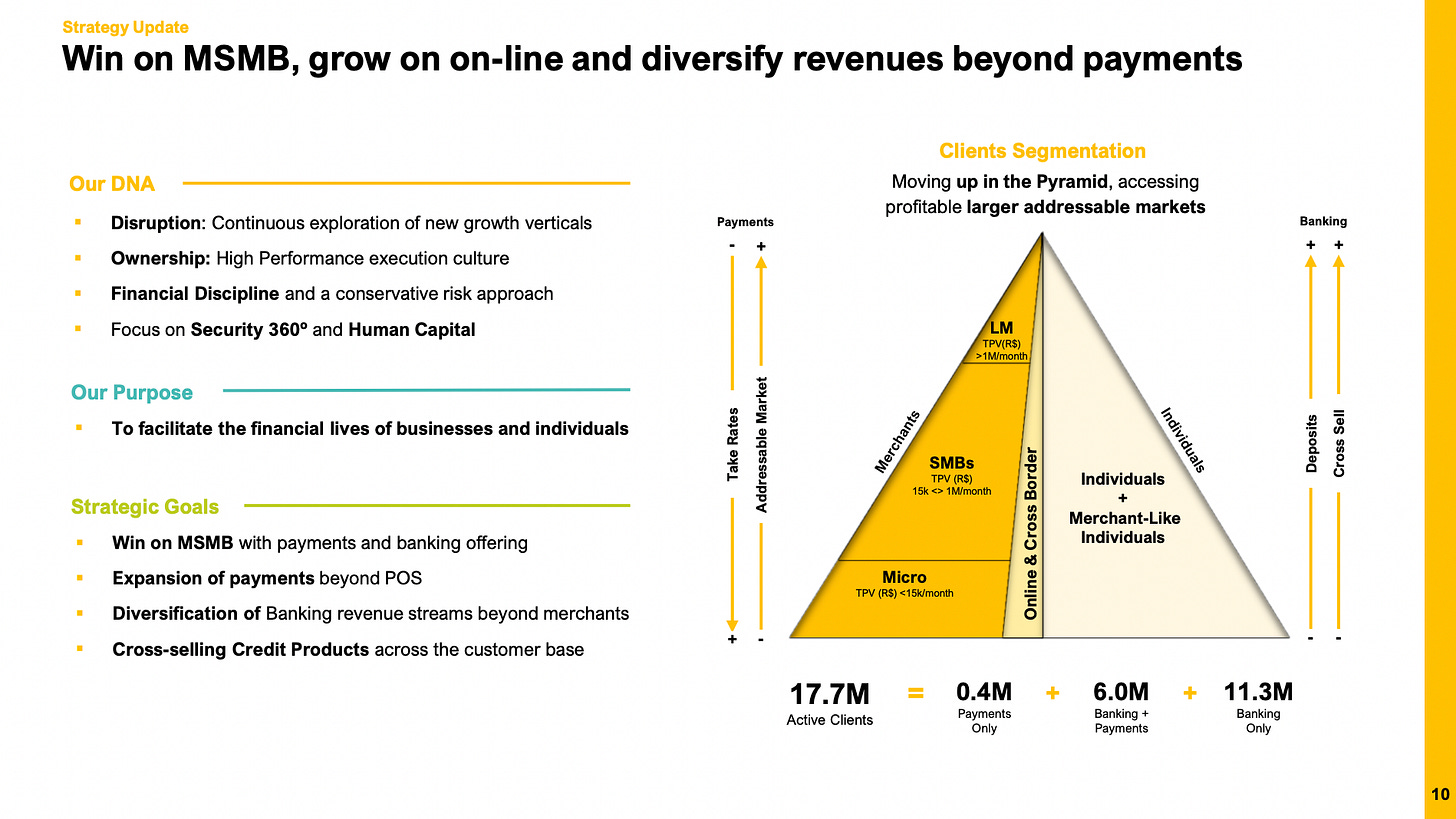

Today, PagSeguro is moving upmarket, chasing e-commerce, enterprise, and cross-border flows under a strategy they now brand “LMEC.” It’s not a branding exercise; it’s survival.

PIX is spreading beyond Brazil. Larger merchants need real tools, not just card readers, but:

fast settlement

clean APIs

reconciliation tools

cross-border support

embedded bank services

PagSeguro is building that stack. Enterprise volume grew in Q4. Retention is strong. But their core remains micro merchants. That’s both the opportunity and the risk.

PagBank: More Than a Free App

PagBank is slowly maturing from a customer acquisition engine into a monetizable base. Deposits are rising. Loan-to-deposit ratios are still under 35%, leaving room to grow if credit conditions behave. Losses are narrowing. The curve is bending in the right direction, just slowly.

Management finally understood what the market wanted: capital returns. PagSeguro is sitting on R$2.2B in net cash and earning a 13% ROE. That’s too much capital doing too little. So they responded:

buyback authorization

dividend plans

public commitment to improving capital efficiency

Fintechs rarely pivot toward discipline. PAGS is doing exactly that.

StoneCo: The High-Touch Execution Machine

StoneCo took the opposite path. Where PagSeguro blitzed Brazil with cheap hardware, Stone built a relationship-driven franchise, localized sales teams, real support hubs, and dedicated account managers. Not glamorous. Not viral. Just effective.

Their SMB business grew payment volume 20–30% year-over-year in 2024. Retention is best in class. Merchant satisfaction is real. This isn’t just market share defense. It’s an offense.

The Linx Acquisition: Expensive, But Strategic

In 2020, Stone bought Linx, a full ERP suite designed for omnichannel merchants. It wasn’t cheap, and many investors hated it. But ERP is sticky. If your inventory, payroll, fulfillment, and accounting are woven into Stone’s software, good luck switching providers.

This is the same “platformization” strategy Shopify and Square used:

own the rails + own the software layer = own the relationship.

Stone wants that same moat, but with real humans in the loop, not just dashboards.

Stone’s Credit Engine Is Quietly Working

After the 2021 credit mishap, Stone rebuilt its loan book the right way, slowly, securely, and data-driven. Today:

loan book: R$1.08B

quarterly growth: +25%

early-stage NPLs: stable

underwriting: backed by real merchant data

It’s cautious growth. Smart growth. And it’s starting to matter.

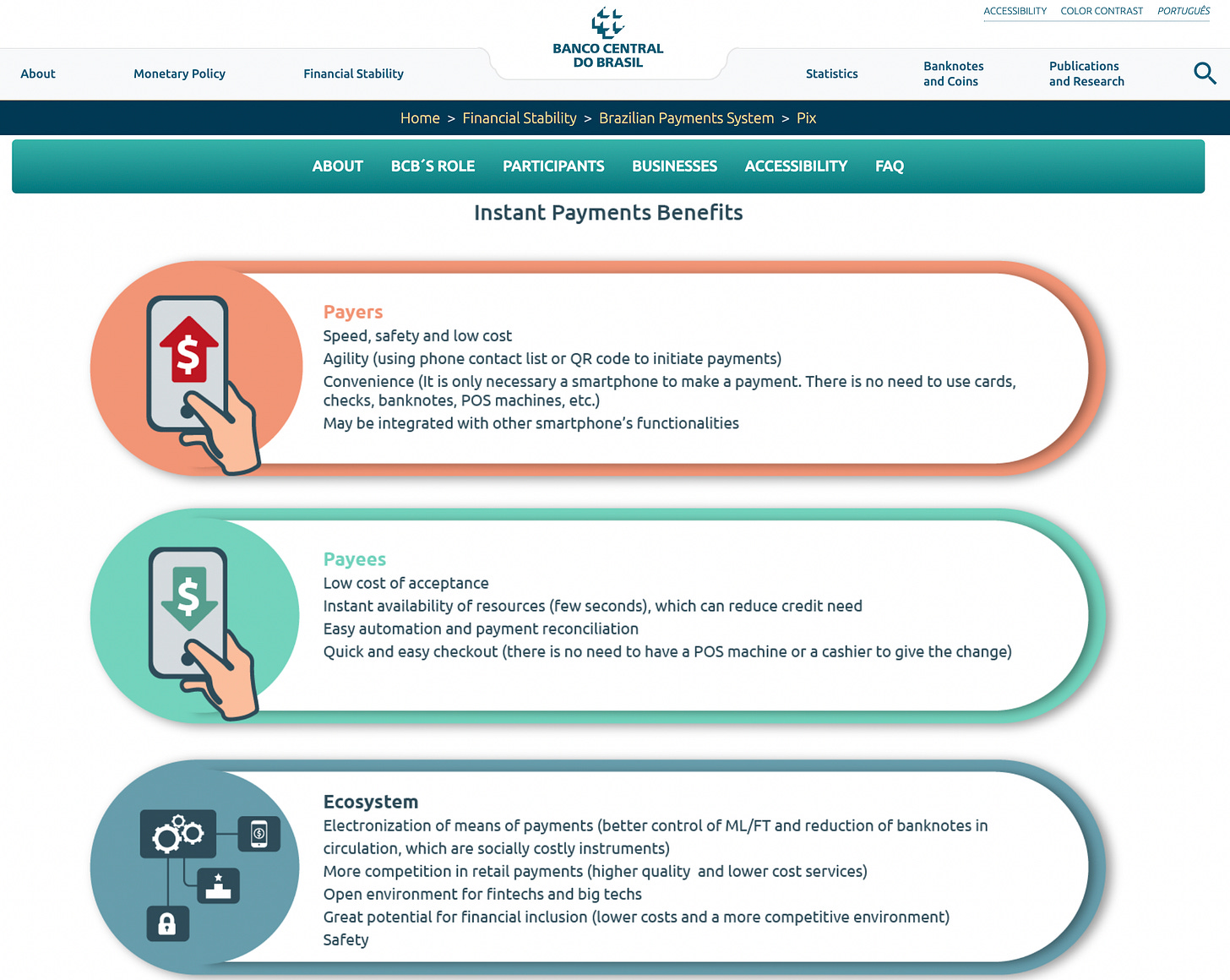

PIX: The Wrecking Ball Reshaping Brazil’s Payments Economy

Now let’s talk about the real disruptor in the room.

It’s not Nubank.

It’s not MercadoPago.

It’s not even the fintechs themselves.

It’s PIX.

Brazil’s instant payments system processed 64 billion transactions in 2024, up 53% year-over-year. PIX now represents roughly 45% of all payment transactions in the country, and its total volume is 80% higher than credit and debit cards combined.

Let that sink in.

The Central Bank created a real-time, free-to-consumers payment system that leapfrogged Visa, Mastercard, and every acquirer in the country. That’s not disruption. That’s displacement.

How PIX Breaks the Old Economics

Acquirers like Stone and PagSeguro traditionally made money through two pillars:

Take rate: a percentage fee on every card transaction

Float: the interest earned during the gap between a purchase and the settlement of funds

PIX destroys both.

It’s instant, so there is no float.

It’s direct bank-to-bank, so card networks get cut out entirely. And the margins? Paper-thin.

So acquirers had a choice: evolve or die. They chose to evolve.

PagSeguro’s PIX Strategy

PagSeguro leaned in fast. They built:

PIX payment links for micro merchants

embedded checkout APIs for e-commerce

Instant settlement flows

early plans for PIX-powered installments (NuPay style)

It’s less about the payment itself and more about the software layer around it, auditing, reconciliation, reporting, chargeback tools, and integration into merchant workflows.

PIX is the platform. PAGS wants to sell the infrastructure around it.

StoneCo’s PIX Strategy

Stone integrated PIX directly into its ERP ecosystem. Every PIX payment is automatically:

recorded in inventory systems

synced to accounting

embedded in audit trails

fed into merchant analytics

This is where Stone’s Linx acquisition becomes a weapon. Merchants don’t just want PIX. They want PIX wrapped in software that simplifies their entire back-office. That’s the monetizable piece.

Neither company will make big margins on the PIX payment itself. The margin comes from everything you build around it.

Lula, Regulation, and the Brazilian Randomness Factor

Brazil’s regulatory environment is never boring. And every fintech operator knows one truth: when you operate at scale, you’re always one headline away from a surprise.

PagSeguro learned this the hard way.

The Online Gambling Hit

PAGS became one of Brazil’s major processors for online betting, right until Lula decided to tighten rules. Licensing got stricter. TPV fell. The vertical shrank overnight.

High-margin revenue?

→ cut downVolume expectations?

→ revised2025 guidance?

→ softer

This hit PagSeguro, but not StoneCo, which wasn’t exposed to betting flows.

Will the Government Target Prepayment Fees or SME Credit Next?

PIX was a massive regulatory swing. If Brasília wants to show consumer-friendly action again before the 2026 elections, new rules could be dropped, like:

caps on prepayment fees

stricter lending standards

new PIX installments oversight

Any of these would hit acquirers and fintechs much harder than the major banks.

But there’s another side to this: Lula’s approval ratings are low, and the last thing he wants is unrest from the small-business base. Fintechs help these same small businesses survive. The government can only push so far.

For Stone and PagSeguro, the rule is simple:

Brazil’s regulatory roulette never ends, but the playing field is the same for everyone.

Traditional Banks Aren’t Dead. They’re Awake and Fighting Back.

To understand the competitive landscape, you need to appreciate how far Brazil’s major banks have come. They’re not coasting anymore.

Itaú, Rede, Cielo: The Old Guard Learns New Tricks

Itaú has become a machine. Their cost ratios, digital performance, and capital returns make them one of the most efficient banks in the world.

Bradesco and Banco do Brasil are still profitable, still paying dividends, but structurally slower to modernize. Their merchant acquiring arms (like Cielo) have been beaten down, losing share to fintechs.

Yet collectively, these incumbents offer:

15–20% ROEs

stable deposit bases

nationwide infrastructure

pricing power when needed

They are dinosaurs, but they’re fast-moving dinosaurs now.

BTG Pactual: The Investment Bank Assassin

BTG trades around 10× earnings with a high-teens ROE. It’s capital-light, tech-forward, and growing in wealth management. But it’s also tightly held, with governance quirks and a lower ceiling than the fintechs.

Bottom Line

These traditional players aren’t collapsing. But they’re also not compounding at the same rates as the fintechs. And they certainly don’t have the same upside from macro easing.

Enter the Apex Predators: Nubank and MercadoPago

Now let’s talk about the real killers.

Nubank and MercadoPago are not competitors. They’re existential threats.

Nubank

80+ million customers

$55B+ market cap

a low-cost funding engine

and now… merchant payments ambitions

NuPay is a shot across the entire industry’s bow.

NuPay lets users:

pay with PIX

pay in installments (up to 24x)

settle instantly for merchants

avoid credit card fees entirely

This directly threatens:

StoneCo’s margins

PagSeguro’s core micro-merchant business

the entire legacy card ecosystem

Once Nubank integrates in-store payments at scale? StoneCo and PAGS will feel it. Deeply.

MercadoPago

Backed by a $100B MercadoLibre empire, MercadoPago dominates:

online sellers

micro merchants

cross-border e-commerce

MercadoPago can underprice everyone because it prints money at scale.

This is not someone you want targeting your vertical.

So, Why Aren’t Stone and PAGS Dead?

Because they still have:

Deep merchant relationships

Embedded software moats

High retention

Strong TPV growth

Better profitability than the market assumes

The competition is brutal, but these companies remain structurally relevant.

Balance Sheets, Profitability, and What Actually Matters

When you stack StoneCo and PagSeguro side by side, the differences in balance sheet structure and rate sensitivity become obvious. These companies may operate in the same ecosystem, but they are not built the same.

PagSeguro: Conservative, Cash-Heavy, Under-Earning

PagSeguro is sitting on R$6.2 billion in cash against ~R$4 billion in debt by 2025. That makes them one of the most under-levered fintechs in the region.

Strengths:

clean balance sheet

regulatory ratios comfortably above thresholds

low loan-to-deposit ratios

strong liquidity

Weakness:

ROE stuck around 13%

loads of idle capital dragging down returns

a business that could earn more but isn’t, yet

The good news? Management finally got religion on capital returns.

They’ve signaled:

dividends

buybacks (authorized ~5% of market cap)

a more disciplined capital allocation framework

PagSeguro’s problem isn’t solvency or competition. It’s efficiency. Once they fix that, ROE rises, and the multiple follows.

StoneCo: Higher Leverage, Higher Upside, Higher Sensitivity

Where PAGS plays defense, StoneCo plays offense.

Stone is riding with ~R$6.9 billion in funding debt by 2025. That sounds heavy until you look at the other side: Stone’s earnings are massively levered to SELIC.

Their quarterly interest expense is over R$1.0 billion.

A 300 bps SELIC cut could double net income.

This is one of the cleanest macro-levered earnings setups in EM fintech.

If Brazil cuts rates, Stone snaps upward hard. If Brazil doesn’t, Stone grinds.

There’s also the intangible noise from the Linx acquisition. Linx muddies the headline ROE, but tangible ROE is significantly higher than the 5–11% reported. And StoneCo has been quietly returning capital, shrinking share count by 14% since 2023. That’s not noise. That’s a real shareholder yield.

Stone is not weak. It’s coiled.

PIX: Expansion, Not Destruction

Before moving on, one crucial point:

PIX didn’t destroy the Brazilian payments industry. It expanded it.

More transactions.

More formalization.

More digital adoption.

More merchant behavior is shifting online.

Stone and PagSeguro don’t need PIX margins. They need PIX volume. And they’re getting exactly that.

So What’s Priced In?

In a single word: fear.

PagSeguro trades at 5–6× forward earnings.

StoneCo trades at 7–10× forward earnings.

Both produce 20%+ growth in their core lines of business.

Both have strong merchant ecosystems.

Both have derisked the biggest problems critics point to.

But the market? The market is pricing them like they’re dying.

Here’s the actual picture:

PagSeguro

Revenue up 19%

EPS up 27%

strong TPV growth even excluding gambling

capital returns incoming

PagBank accelerating

still gaining merchant share

StoneCo

EBITDA margins 50%+

merchant retention best-in-class

loan book scaling (R$1.08B and growing)

credit losses stable

ERP + payments bundling ramping

interest sensitivity = explosive upside

These are not dead businesses. These are mispriced businesses.

Earnings Call Reality Check

The market’s skepticism was deserved… two years ago. But today?

StoneCo fixed:

prepayment yield dependence

credit underwriting mistakes

brand overspend

bloated cost structure

They now have:

disciplined growth

cleaner credit books

software-driven stickiness

real capital returns

PagSeguro fixed:

overcapitalization

undisciplined PagBank burn

risky gambling TPV

pricing too soft

They now have:

repricing underway

improving PagBank metrics

Rapid TPV growth even without gambling

Real talk about dividends + buybacks

The critiques are outdated. Execution is real.

The Brazil Macro Setup

This entire trade hinges on Brazil’s macro environment. The most underappreciated part of this entire story.

Right now:

SELIC is still high

Inflation is sticky

The real has been hammered

Business sentiment is weak

Foreign flows have left the country

Translation: Vibes = awful.

Which is exactly what creates opportunity.

If SELIC falls 100–300 bps:

StoneCo’s net income could double

Fintech valuations could re-rate 30–70%

credit spreads tighten

FX stabilizes

Flows return to EM

Brazil doesn’t need a boom. It just needs “less bad.”

StoneCo vs. PagSeguro: Who Wins What?

PagSeguro (PAGS)

Safer, steadier, underpriced. A rerating does not require macro fireworks.

It only requires:

modest execution

improved PagBank operating leverage

At 5–6× earnings, small wins go a long way.

StoneCo (STNE)

Riskier, more explosive. If Brazil enters a real easing cycle, Stone’s earnings don’t just rise, they jump.

Stone is the rate-levered call option. PAGS is the steady compounding machine waiting for recognition.

Together? They create an elegant barbell:

PAGS = downside cushion

STNE = upside asymmetry

And if you’re nervous about macro? Short a traditional bank (Bradesco or a card-heavy incumbent) as a hedge.

The Real Question: What’s Already Priced In?

Everything bad.

Lula fear

PIX fear

SELIC fear

competition fear

macro fear

governance fear

consumer slowdown fear

Brazil’s fintech sector has been priced for failure. Yet the businesses themselves aren’t failing. They’re stabilizing, executing, and improving.

This is where the rerating setups live. Not in hype cycles, in forgotten, mispriced, under-loved sectors where fundamentals are quietly turning.

Final Take: Asymmetry Is Back in Brazil

PIX isn’t killing the fintech model; it’s evolving it.

Nubank isn’t destroying merchant acquiring. It’s expanding the pie.

MercadoPago isn’t squeezing the sector. It’s professionalizing it.

PagSeguro and StoneCo aren’t hype. They’re survivors. And survivors are the ones who react hardest when macro flips.

Brazil doesn’t need perfection for these to work. It just needs stabilization.

When you put it all together, the conclusion is simple:

Too much fear is priced in.

Not enough execution is being recognized.

And almost zero upside is being priced at all.

This is exactly where asymmetric trades live.

Until next time,

Victaurs