Robinhood (HOOD) Stock Analysis: Cyclical King or Overpriced Call Option?

A 2025 deep dive into Robinhood’s fundamentals, growth bets, and whether this stock still deserves a spot in your portfolio at more than 20x revenue.

Let’s just call it out: when you buy an equity and crypto broker-dealer, you are buying a cyclical stock. Some will disagree, but the truth is simple. A business that makes money from transactions, from money changing hands, is cyclical. When markets rise and people are making money, they transact. When markets fall and capital is scarce, they don’t.

I still own HOOD (read on for positioning) but that is the bet you are making, one of cyclicality.

Back in April, when the stock was trading around $45, I wrote that Robinhood was hated. I understood why and I didn’t trust Vlad. But the company had just grown revenue to $2.9 billion, with nearly 60% year-over-year growth. My thesis was that HOOD was effectively a call option on a bull market in stocks, options, and crypto. That turned out to be right and the stock is now at $135. That is a 3x return, or 200% over 7 months. Congrats longs (and me).

But for the haters, the risks haven’t disappeared. Robinhood still caters to users many dismiss as gamblers and degens. The average account is just over $12,000. Vlad’s reputation still has baggage. Revenue growth in 2026 is projected to be 20% according to the company and closer to 15% according to the Street. The stock is down 10% this month and now trades at 20x 2027 revenue. That is expensive no matter what way you slice it.

So now we are sitting on a big gain from what was a call-option-like bet. But forward growth is slowing, and the setup feels more fragile. Tough spot. On one hand you hate to take gains on a giant win. On the other hand you have to see things for what they are going forward.

Should you be buying it here? Well in the end that’s up to you. Here’s how I’m thinking about it though.

First, I do not think HOOD is a joke anymore. It used to be, it’s not anymore. That was the thesis I had back in April when it was $40 a share.

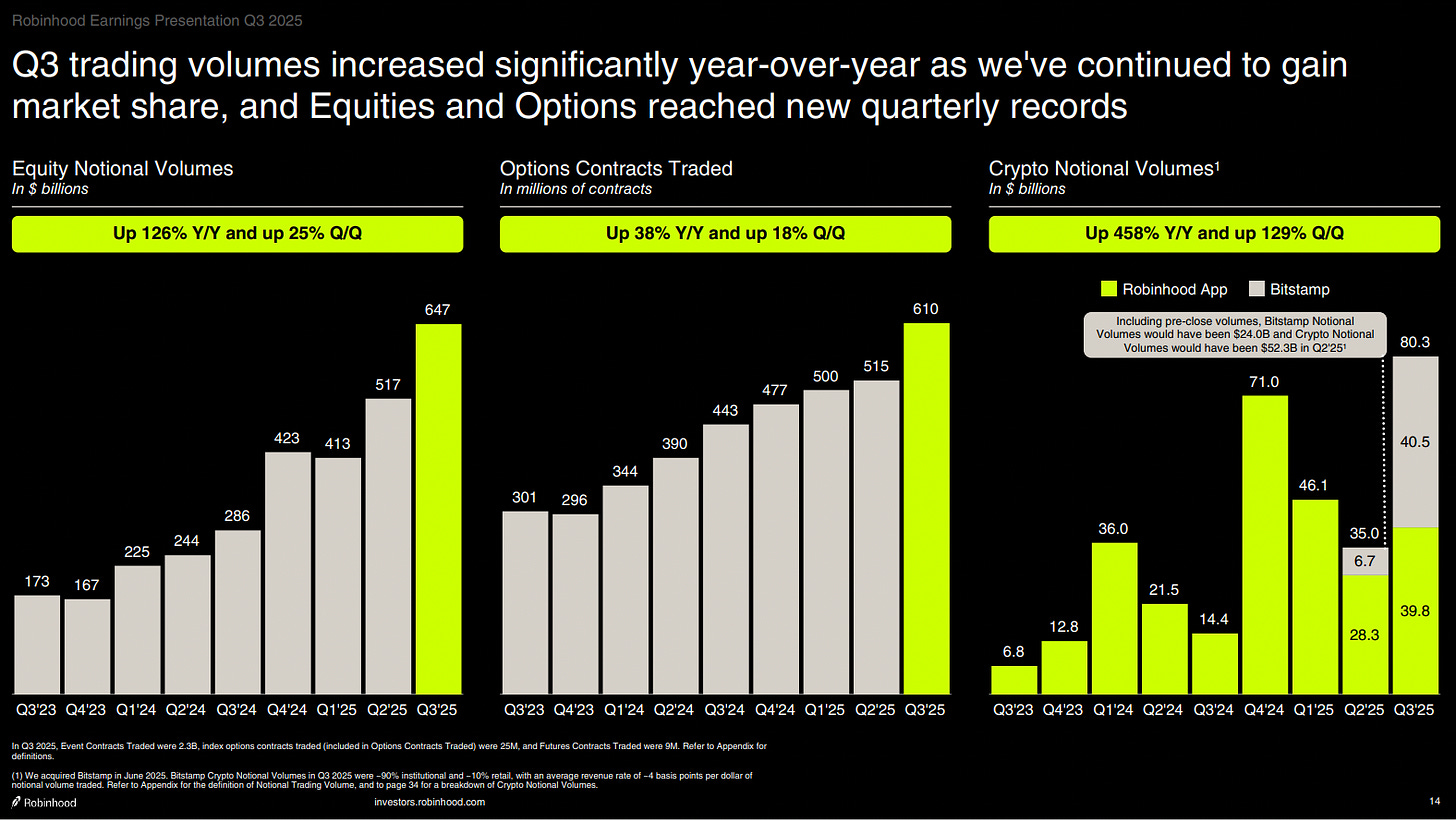

The numbers today more or less validate that. They just posted $742 million in EBITDA, up 177% year over year. Margins were 58% including SBC, closer to the mid-40s without. Q3 revenue hit $1.27 billion, up 100% YoY compared to Q3 of 2024. ARPU reached $191 and transaction revenue doubled. All good things yes.

Breaking down their revenue side, 42% came from options, 37% from equities, and 12% from crypto. So before moving forward, ask yourself: will activity in options, equities, and crypto rise in a flat or bear market? Probably not. If this is true, then you must admit that this stock is an “animal spirits” or cyclical stock that benefits from increasing prices & increasing volumes.

Everyone talks about how Robinhood is diversifying. But let’s be clear: more than 60% of its revenue still comes from trading activity.

The 36% of revenue that is not trading activity now comes from interest income, margin lending, cash sweep, and securities lending. Another slice comes from Gold subscriptions and small service fees, which is growing. So yes, they’re making progress. But when the market cools, this still behaves like a brokerage built on dopamine.

And this is the big key for the risk/reward trade-off today.