Q1 US Bank Earnings Outlook: Key Trends and What’s Next

Q1 US bank sector breakdown covering earnings stability, regional bank pressure, rate scenarios, capital markets tailwinds, and where opportunities may emerge.

A full sector read, what mattered this quarter, and what actually moves bank stocks from here.

There are three major forces shaping bank stocks right now. I am constructive on the sector but not pounding the table. Call it a six out of ten environment. Not bearish. Not euphoric. Just a market that is finally, slowly, acting like it remembers how banking cycles actually work.

Below are the biggest takeaways after working through this quarter’s earnings releases across large caps, regionals, and the small bank universe.

If you like clean, high-quality breakdowns on banks, credit, and financials, subscribe here for more.

The Big Three Forces In Banking Right Now

These three forces form the backdrop for everything we’re seeing in earnings, valuations, and market sentiment this quarter.

1. Boring Is Good

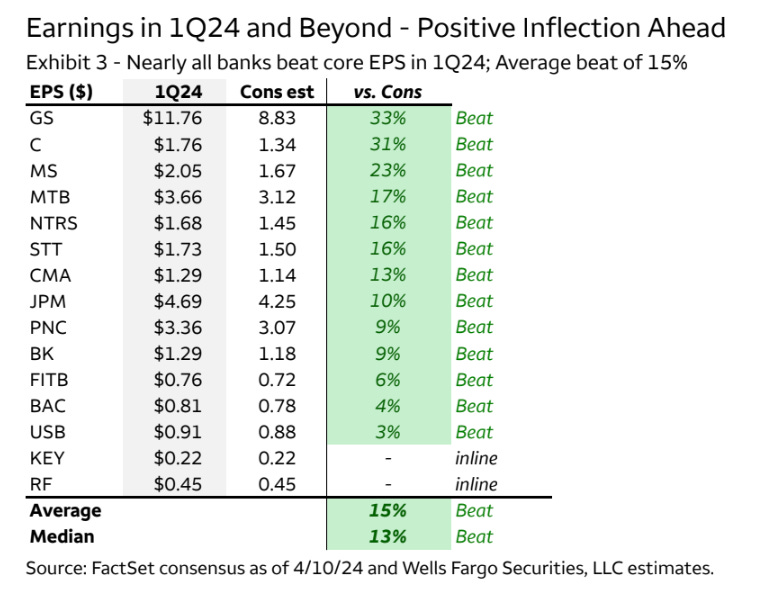

This quarter was boring in the best possible way. Banks broadly beat expectations, which were already beaten down, and credit was shockingly uneventful. Very few issues in commercial real estate, odd as that is, and more commentary around C&I than anything else.

The margin bears took real damage. Deposit beta acceleration is slowing, the deposit mix shift did not surprise anyone, and funding costs are flattening. If you are long banks, you should be hoping for more of this. The pathway to higher stock prices runs through dull, repeatable, uneventful quarters.

It is boring. And boring work.

2. Earnings Growth Is Finally Getting Closer

Since the world did not collapse, depositors are no longer playing bank run on their phones, and balance sheets have strengthened, the narrative can begin shifting back toward growth.

Earnings growth in the banking sector happens when NIM stops compressing and when asset yields plus loan growth can outrun funding costs. This requires credit stability. For most banks, the earnings inflection looks like a late 2024 event. For a few, it is coming earlier.

3. Fear Is Fading

On Friday, FRBK failed. Markets barely noticed. FULT acquired deposits for almost nothing. The FDIC quietly resolved a zombie bank without triggering contagion or headlines.

There are more failing banks coming. Everyone knows that. But the fear is gone, and the market is numb to it. That is healthy.

Where Are We Now?

I listened to many calls this quarter. I was not hunting for a specific datapoint but rather listening for tone and tempo.

Big Banks: Less Bad Is Good

The large banks all beat expectations. Yes, those expectations were already lowered, but the broader point stands: this is not what a sector in crisis looks like. Less bad is good. Everything behaved.

Regionals And Smaller Banks: Mixed, But Mostly Functional

Regionals were a mixed bag but skewed positive. Here is what stood out:

The Weak Links:

Banks like FFWM, EGBN, BRKL, and VLY got hit because they run liability-sensitive balance sheets with heavy CRE exposure. It is not a great environment for that model. Their earnings showed it. Their price action confirmed it.

These banks are playing poker while sitting on a rates-down river card. If rates fall, they look like geniuses. If rates rise, they get punished.

The Bright Spots:

MCB raised deposits.

TRMK beat expectations and announced another strong insurance sale.

MYFW rallied after updating resolutions on problem loans.

FCNCA once again reinforced that it is a machine.

UVSP put up some of the strongest results of the entire group.

CASH even posted a solid win for the BaaS category.

Strong results are being rewarded. The market has not forgotten how to differentiate. And that matters.

Year to date, regionals are still down sharply. It is tough out there. Some winners exist, but it is not a segment you can overweight without a crystal ball on interest rates.

Where Do We Go From Here?

I do not carry a crystal ball. My bias is slightly positive over the next two to three quarters. I expect choppiness, but I also expect Q3 to begin showing relative outperformance versus the broader market.

Here is the bank bull case in plain language:

If the economy stays stable

If liquidity stress stays muted

Then bank earnings can start growing again while parts of the S&P begin decelerating. MAG7 earnings growth is not what it was. Some of the shine has come off. That sets up a scenario where banks, starting from reasonable valuations, become one of the few sectors showing earnings growth into 2025.

Generalists will return only when that becomes obvious.

The Fast-Track Scenario: Rates Down And Curve Normalization

If rates fall and the yield curve inverts, you get:

CoF relief for COF-sensitive names

NIM expansion

Operating leverage

AOCI accretion flowing into tangible book

Much higher buyback capacity

This would be a powerful EPS tailwind across the sector. And it would embarrass all the early 2023 doomsday predictions about SCHW, BAC, and others blowing up. Shoutout to the OG AOCI bears. Gone but not forgotten.

How Banks Actually Outperform Over Time

This is the simplest lesson in the industry:

Banks that outperform grow top line, grow bottom line, and grow tangible book value per share without doing something stupid.

That is the formula. Nothing fancy. Investors overthink this endlessly.

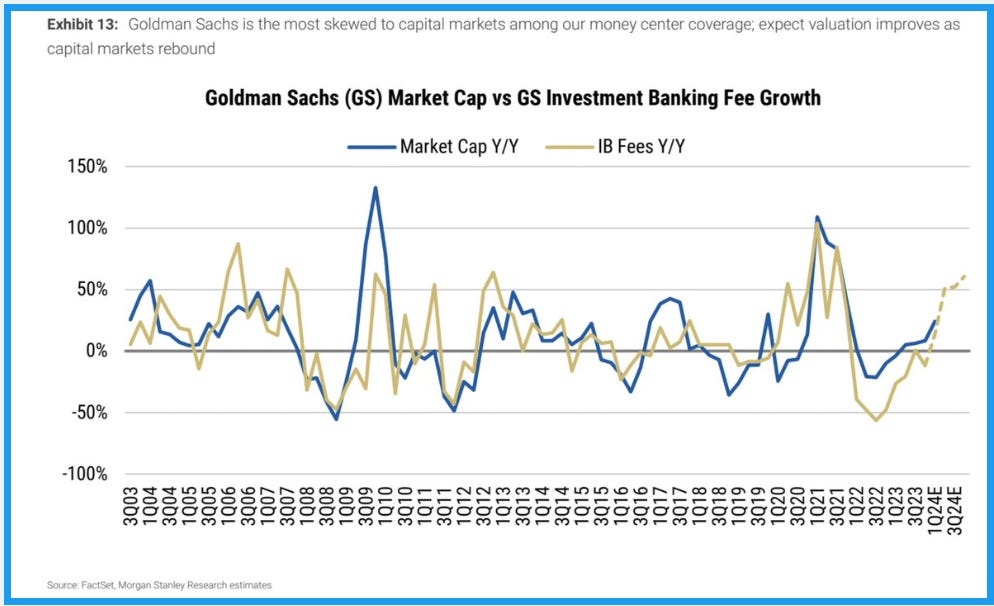

One category I am focused on is capital markets banks like Goldman Sachs.

If the world stays reasonably stable, the capital markets windows reopen. That means:

More IPOs

More equity issuance

More debt refinancing

More M&A

More fee revenue

I am not calling for a return to 2021, but meaningful upside relative to baselines is realistic. Going into an election, policymakers want functioning capital markets. GS is a direct beneficiary.

Closing Thoughts

The pathway to winning in banks is not complex:

Boring quarters win

Time passing wins

Rates down accelerate everything

Regional banks need rates to come down to truly break out

Large banks are positioned to benefit from stability and capital markets

Liability-sensitive CRE banks remain disadvantaged

European banks still look better on a pure return and valuation basis, but the US is improving. If you want to talk through names, send me a DM on X.

And if you enjoyed this breakdown, share it around. The paywall is coming eventually, but today is not that day.

Until next time,

Aurelius