Private Market Players Are Quietly Winning & Everyone Thinks They'll Blow Up, Which Is Why I'm Interested

If you’re even remotely curious about Alternative Managers, this one is for you. Or put differently, if you’ve ever heard someone casually mention private equity or worse, drop the term "private credit," and found yourself wondering what it actually means, this is the deep dive you’ve been waiting for.

It’s behind the paywall, yes. But this one is worth it. Because as I like to say, I try not to miss when it comes to financials.

And let’s be real, the past few months have been rough across the public markets. Banks got crushed. Real estate took a beating. Investment banks were monkey-hammered, although some of you rode that short side with us. Bond liquidity evaporated. Credit spreads widened. Everyone started panicking. And alternative asset managers, long seen as the inevitable winners of every market cycle, weren’t spared either. Blackstone, Apollo, KKR, and the rest all got tagged. Valuations compressed. Management turned cautious. Fundraising slowed. Pretty much all the bad stuff, all at once.

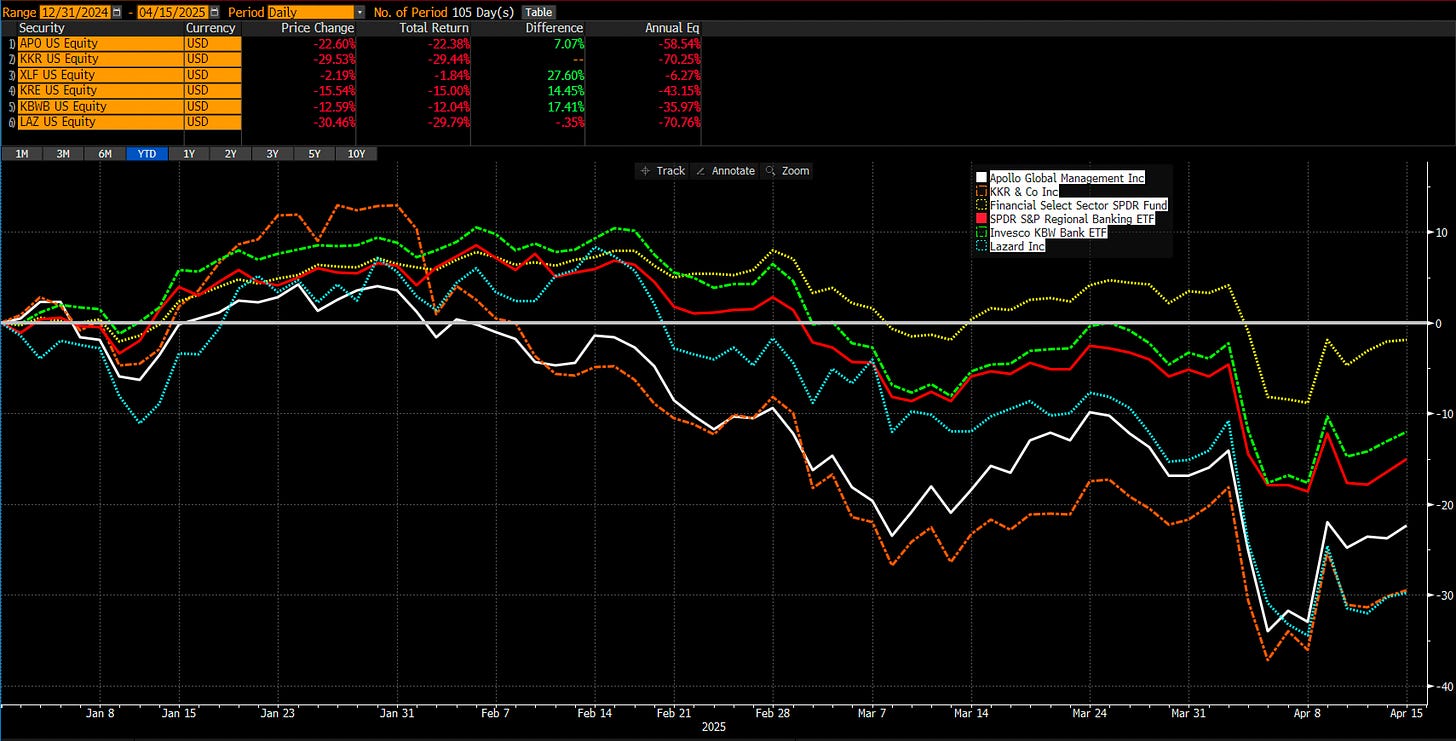

The vibes went from “Trump so good” to “Trump so bad” seemingly overnight. And we went from buy the dip, to sell the rip. Cyclicals got smoked. Apollo sold off 22 percent. KKR dropped 29 percent. This, while financials as a sector are only down about 2 percent. Regional banks are off 15. Big banks are down 12. Lazard, a clean investment bank proxy, is off nearly 30.

I’ve invested in banks for over a decade and a half (why … I’m beginning to wonder). I’ve seen this playbook. When liquidity tightens, anything tied to leverage or credit gets sold fast and indiscriminately. But alternatives aren’t banks. Banks are cyclical. Investment banks are cyclicals plus. And alternatives are mega-cyclical. They don’t just bounce when capital flows return. They take off. They thrive when M&A wakes up. When IPOs start again. When corporate credit windows re-open. That’s when these firms go from defense to offense.

Behind the paywall, I lay it out cleanly. What alternative managers actually do. How they make money. Who’s best positioned for what’s next. And why this selloff is starting to look like a gift. If you’re serious about financials, or just want to understand the future of capital markets, this one is worth your time.

You can also just skip to the end to hear what I like. You will enjoy this one.