Cheap Ain’t Enough Anymore ... My Thoughts on US Banks Vs. European Banks

When I wrote Things Done Changed at the end of April, I made it clear: the tilt in banks for me was to the U.S. … and for good reason.

“I think the American Banks are going to outperform going forward.”

“Once we clear this tariff nonsense here in the U.S. and assuming the economy doesn’t go into full blown recession, the American Banks are a much better set up.”

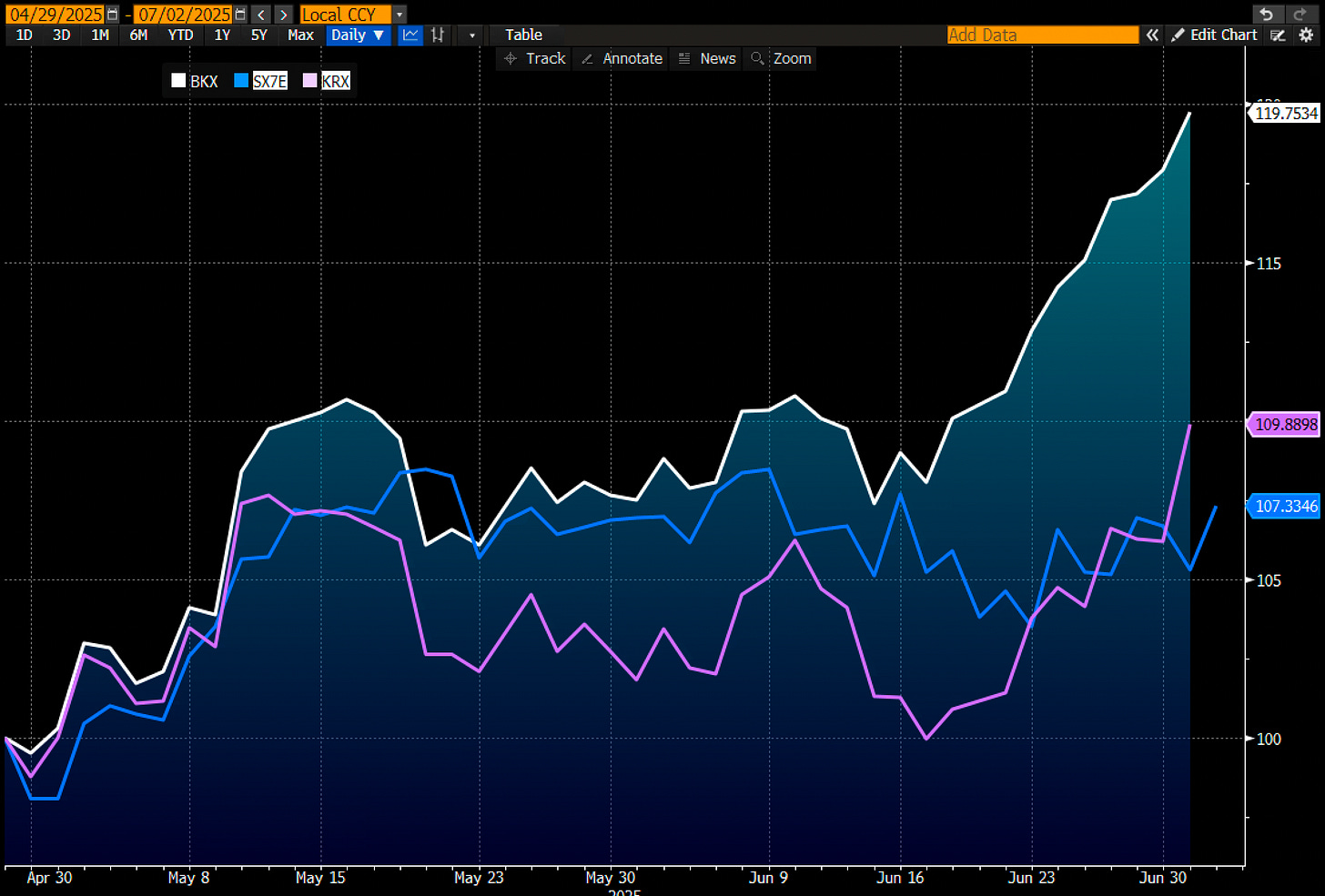

And it’s happening for now, BKX is up 12% on a relative basis to SX7E since the call in the face of a longer term underperformance trend.

Going back a year the catch up is more clear.

First, let’s briefly talk through the why …

Europe went too far too fast.

To start, valuations were no longer completely distressed and the macro in Europe was and almost always is fragile. Also, the rate cycle was turning, and most of the book was asset sensitive heading straight into cuts. You were buying a sector that had already re-rated, with slowing loan growth and no clear earnings driver outside of yield. The time to buy them was when the world thought they were completely a disaster around 6x forwards on a sector basis, not when they’re more fairly valued at 9x forwards.

Meanwhile, the U.S. looks alive again.

Lots of bullish reasons to like U.S. banks. First, the curve is steepening and if the powers that be get their way it will continue steepening, a bullish thing for NIMs. Second, Trump’s handwritten Powell pressure campaign may not be “working”, but is hilarious and points out that the bias out of the admin is for wanting lower rates. Third, Mikki Bowman is out sounding the trumpet for deregulation and freeing up the system from restraints. Fourth, dovish inflation prints and fading hard landing fears are pulling capital back in to the sector. Fifth, the deregulatory push is opening doors for M&A and deals are getting announced faster and closed faster. Sixth, credit remains clean with the potential for lower rates being a gift for CRE and card names. Seventh, stress test results were solid for the largest banks that went through DFAST and SLR relief, even if just optical, gives headline air cover. So you have a confluence of good news. That’s it. That’s the story.

That’s why U.S. banks are catching bids. It’s not one thing. It’s the sum of changes. And the biggest one is this: they’re getting breathing room again. When you strip the sector down to margins, credit, capital, and sentiment, you start to see it. They’re not expensive. They’re under-owned. And they’re still capable of earnings upside surprises if the macro even muddles through.

None of this means Europe is a short. It isn’t. Most of the names are still fundamentally strong. Valuations are still low. The ECB is easing. Capital return is real. But the easy money’s been made. And the risk-reward now leans west.

The torque is here. The turn is underway. And the American banks are back in the game, even though they are carrying a demanding 12x forward sector level valuation.

A Few Screens To Sift Through

Europe positive momentum first, price vs. 50DMA filtered and the RSPM (Relative Share Price Momentum) to the broader universe. Basically these names are all still very strong, but in my opinion stalling with a lack of catalysts for a new move upward using broad brush strokes.

Europe slowing or more negative momentum albeit within the larger and stronger up trend over the longer term time horizon. I am still not short, just lighter and more biased in the U.S.

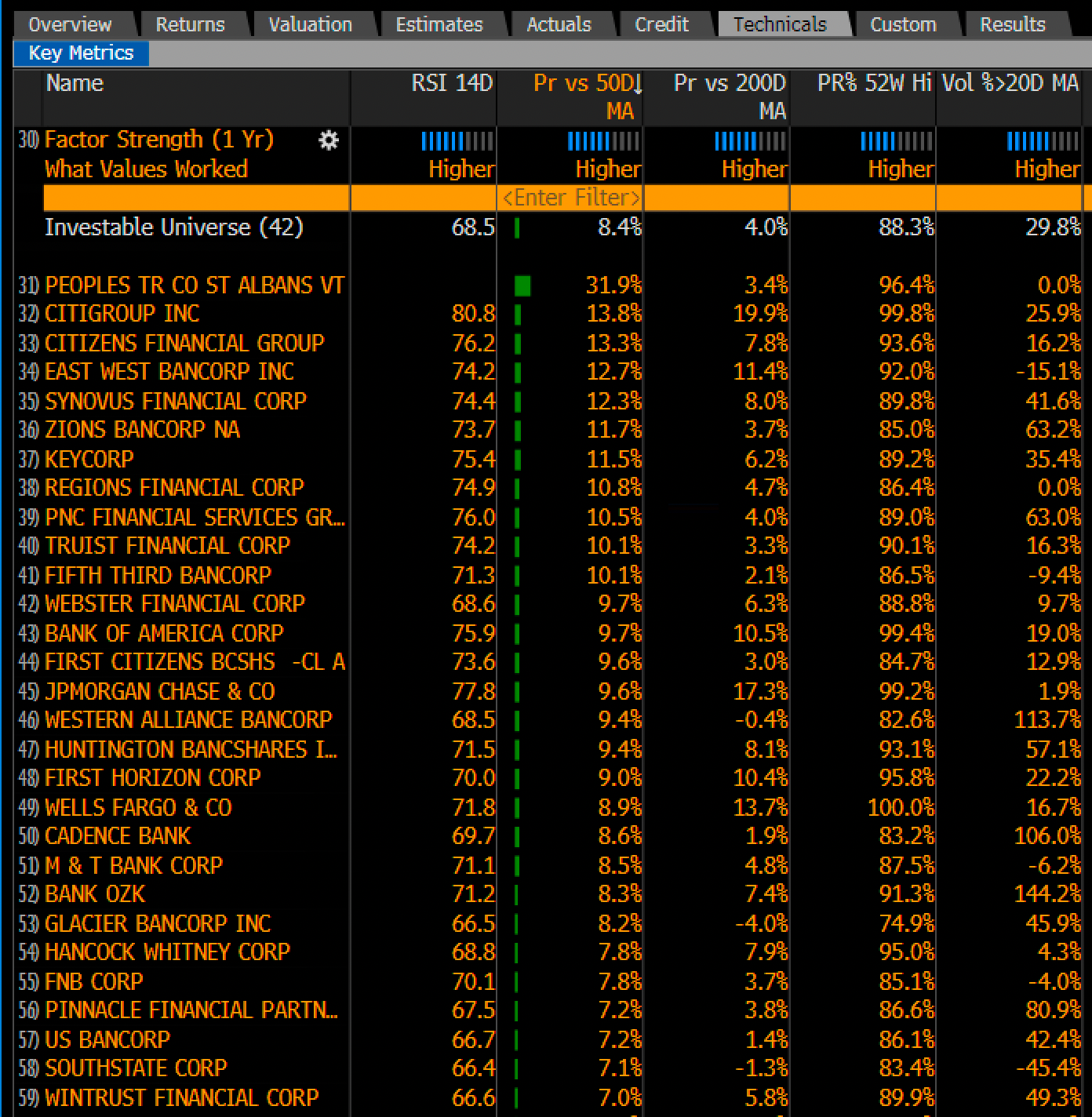

And the U.S. momentum screen, same format but lifting market cap floor to $5 billion. First the 50DMA screen to show shorter term positive momentum. And then the RSPM to broader indices.

Three things you need to remember with banks.

First, banks are cyclical, and the macro still rules the game. Europe’s not falling apart, but it’s dragging. Growth is limp, stimulus is tapped out, and the rate cut cycle has already started. There’s no fire left in the engine. The U.S. might be playing a different tune. Maybe … just maybe … we’re watching the market start to buy into Trump’s “big beautiful boom” argument. Infrastructure, tariffs, reshoring, whatever you want to call it. The setup is shifting toward something more expansionary, not less. That matters for credit demand, for deposits, for sentiment. Macro drives narrative, and the U.S. narrative is heating up again.

Second, valuations matter … but so does the starting point. Europe is still cheaper. No argument there. But it’s no longer dumpster-fire cheap. And the cheap stuff tends to stay cheap unless there’s a catalyst. The U.S. isn’t cheap, but it’s demanding that you believe again. That’s different. You’re paying for upside optionality, not just avoiding downside risk. And right now, sentiment is beginning to turn. Not just on banks. On cyclicals more broadly. You can feel it in the price action.

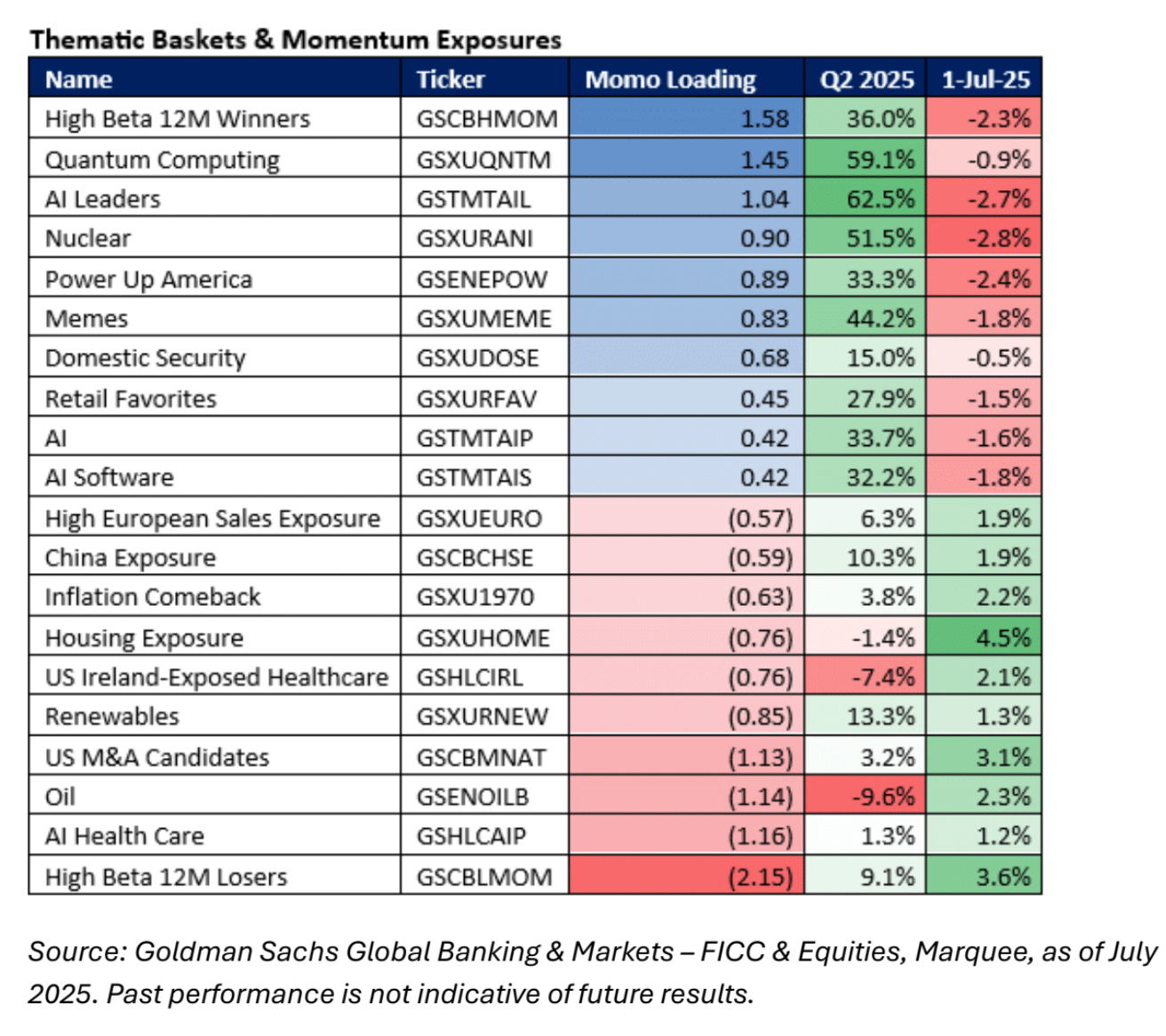

Third, and maybe most important: flows matter. Yesterday, KRE ripped. The Goldman “high beta losers” basket screamed. That wasn’t random. That was the start of a momentum unwind. A reach-for-upside rotation. And banks live right in the heart of that category. They’re the classic high-beta, underloved, cyclically exposed risk asset. When flows turn, they don’t trickle … they flood. And that’s what this smells like … at least for now.

So no, Europe isn’t broken. But the U.S. just got interesting again. Macro setup better. Valuation tradeoff worth debating. Flows flashing green. If this keeps going, the names that were left for dead are the ones that’ll move the fastest. You don’t need to overthink it. Just follow the torque.

As always join premium to get DM access to discuss names, access to the group chat, and find the signal throught the noise.

The best is ahead,

Victaurs