Bank Activism Has Limits Despite What CNBC Wants You to Think

A deep breakdown of bank activism, why the strategy often fails, where it works, and which U.S. banks activists are targeting today.

The word “activist” still brings up a familiar image: a $5,000 suit, slicked-back hair, and a young Gordon Gekko preaching his gospel of capitalism. “Greed is good,” and all that. And yet, somehow, even the usually quiet and spreadsheet-driven world of bank stocks has found its own modern crusader, one eager to “shame” 65-year-old executives as if they were misbehaving school kids.

As a long-time bank investor, people keep asking my opinion. So I stepped back, dug in, and looked at the strategy, the limits, the targets, and how this wave of activism may actually unfold.

The Rise of HoldCo and Its Activist Playbook

The firm drawing headlines is HoldCo Asset Management out of Ft. Lauderdale, managing around $2.4 billion. I don’t know the team personally, but CNBC styled them as the “bad boys of banking,” complete with clasped hands, stiff poses, and the classic “we’re very serious” photoshoot. It’s the kind of media look you get when Wall Street wants you to seem just threatening enough to be interesting. Honestly, I kind of respect it.

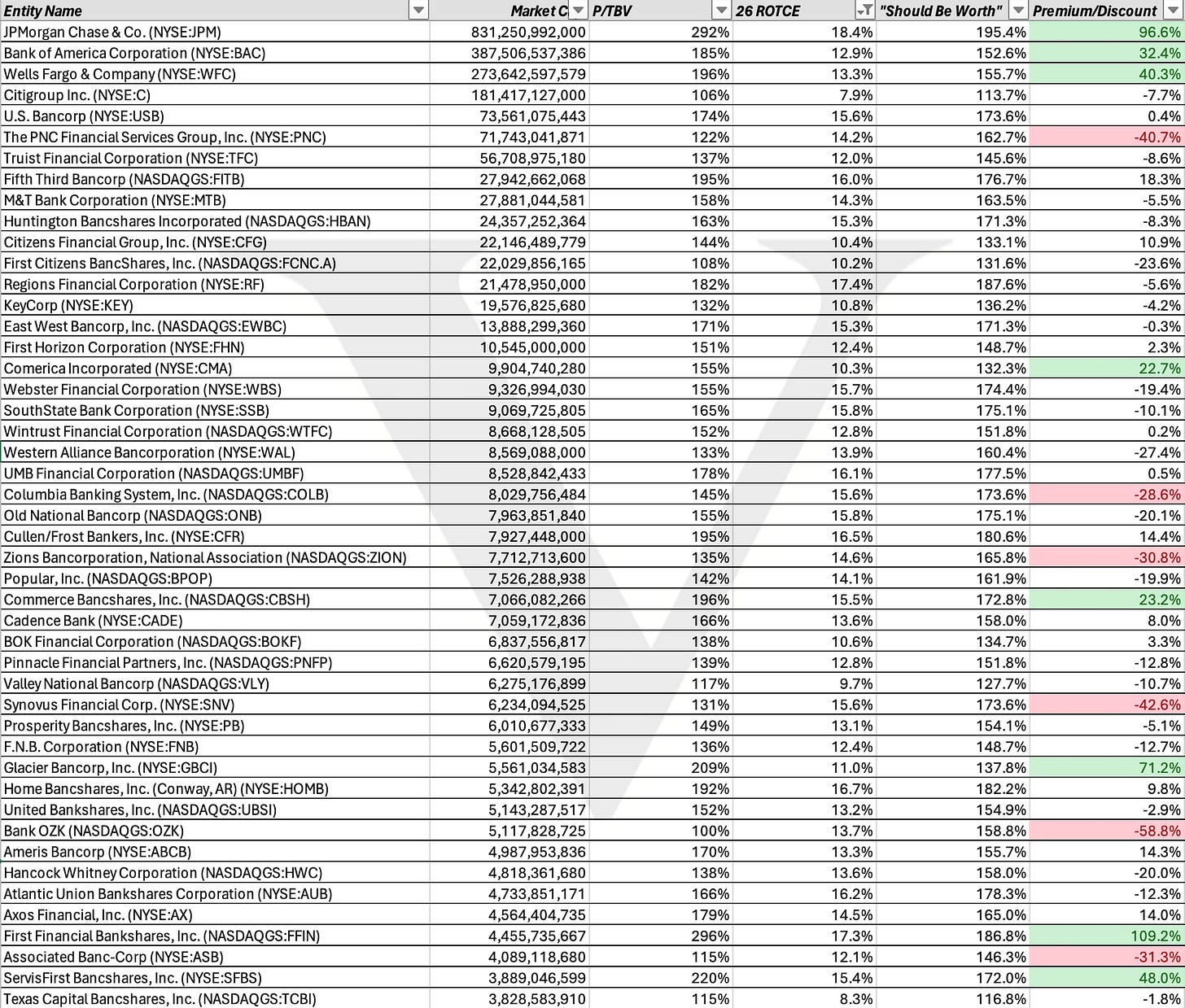

As of Q2, HoldCo’s biggest positions looked like this: roughly $104 million in COLB (2.1% of shares), $102 million in FIBK (3.4%), and $78 million in EBC (2.4%). Combined, that’s nearly 30% of their $1B Fund V. Their model is straightforward: take non-controlling stakes, fire warnings, and push management to get sharper or sell. I respect the end goal, even if I don’t agree with all of the tactics.

Why Activists Can’t Just Target Every Bank

Step back, and the constraints become obvious. For the fund to hit its goals, small banks don’t move the needle. A 15–30% sale premium on a sub-$500 million market cap doesn’t justify a $10–$20 million stake. They need impact. That’s why a 20% jump on a $100 million position matters, while a tiny bank does not.

Another thing: activists are the opposite of private equity. PE wants to own, operate, and compound. Activists flip. They spark change, capture a premium, and move on. Ironically, their strongest weapon, a proxy fight, is also the most painful. It drags out a sale, costs banks $500K to $1M, and usually benefits only lawyers wearing those same $5,000 suits.

The truth is that in banking, for every management team that folds, five others dig in and refuse to budge.

Where the Strategy Starts to Crack

The playbook is simple: find laggards, apply pressure, and demand discipline. A recent Reuters report also noted that several U.S. regional banks increased share buybacks as capital rules eased, widening the gap between disciplined operators and the laggards activists often target.

But it does not always align with reality. Take FIBK as an example. It isn’t particularly cheap, yet HoldCo still pushed for a “no dilutive M&A” pledge that management had already more or less committed to. Maybe HoldCo wanted the public optics. Maybe they wanted acceleration. Either way, activists thrive on speed, not patience.

So what do I really think?

There are three major lessons for banks, bankers, and investors:

The opportunity set is smaller than people think.

Premiums and discounts almost always have reasons.

The “return on hassle” is a real cost, and sometimes I admire activists the way I admire big-wave surfers. Looks thrilling. Not something I personally want to attempt.

The Hard Limits of Bank Activism

Start with the obvious constraint: structure. There are around 400 liquid public banks in the U.S., maybe 90–95 above a $500M market cap. A real stake for a $1B fund requires $50M+ per name.

Then there’s the Bank Holding Company Act. A Federal Reserve release presumes you have “controlling influence” at 10%, even without a board seat. They can force passivity commitments or even require you to divest.

And tender offers? Those require big premiums, drain alpha, and clog the trade. Constraints everywhere.

Where ROTCE Meets Valuation: How Activists Pick Targets

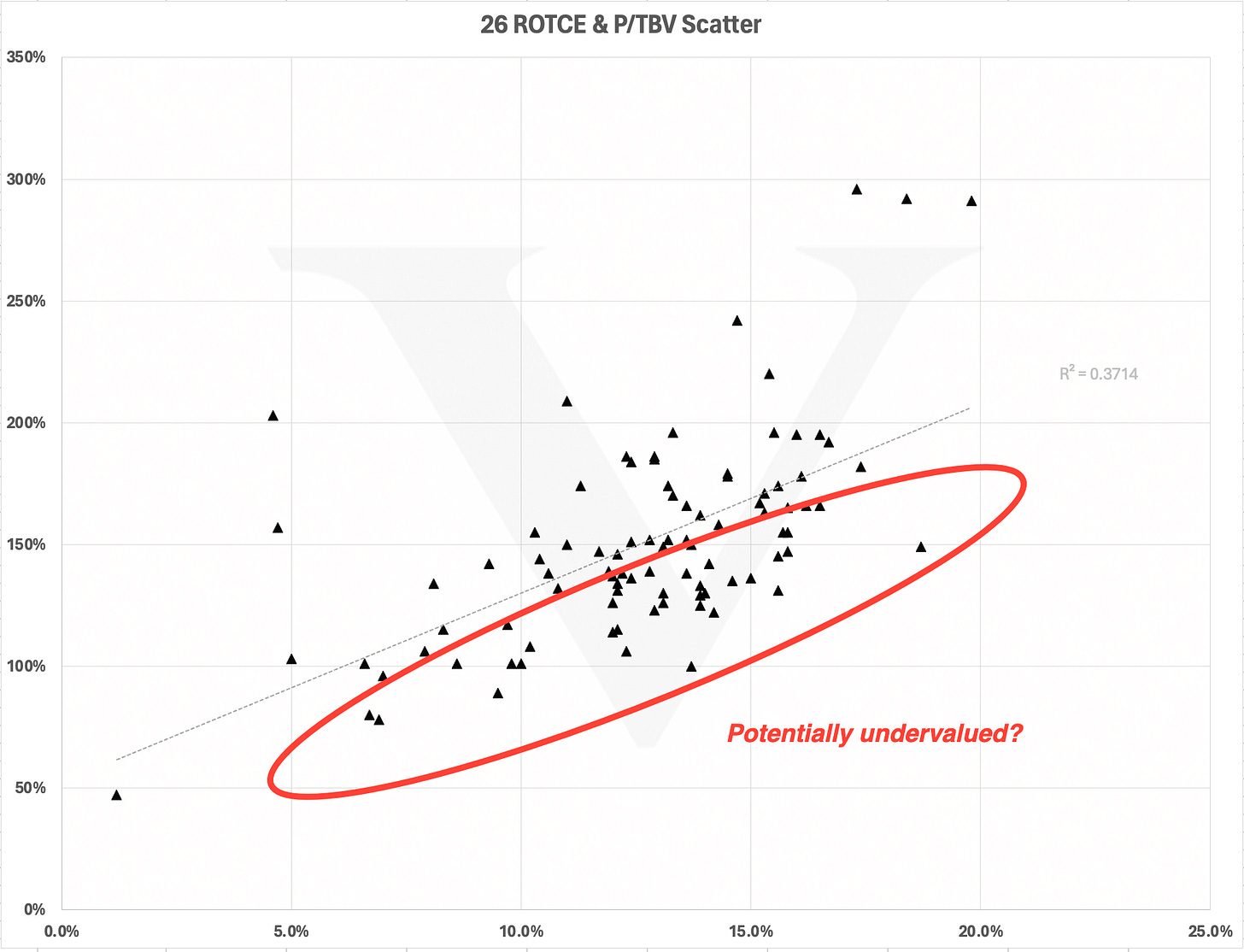

Below is the framework activists use. Rank the 95 largest banks with positive 2026 ROTCE projections. In theory, higher future returns justify higher price-to-tangible-book multiples.

On a chart, the regression line slopes cleanly upward: more ROTCE, higher P/TBV. The outliers below the line are the classic activist fuel.

But charts only tell half the story.

The Good Banks, the Cheap Banks, and the Mispriced Banks

Here’s what stands out:

JPM, BAC, and WFC trade rich because they beat earnings and benefit from constant ETF inflows.

CFG, despite HoldCo’s stake, isn’t an activist setup. It already trades fairly close to implied value.

PNC looks cheap post-acquisition.

FIBK, again, trades around 150% of TBV despite its implied 137% ROTCE valuation, fairly valued, maybe even full.

FCNCA and OZK are doing exactly what activists want: buying back below book and compounding TBVPS while the narrative crowd ignores them.

Banks that consistently compound book value tend to separate themselves over long cycles. If you want a deeper breakdown of how TBV, spreads, credit, and valuation interact, my no-nonsense guide to valuing a bank does a good job outlining the core framework investors use.

Then there is COLB, the textbook activist target. Undervalued, digesting a deal, chasing footprint expansion when buybacks would clearly deliver more for shareholders. A classic tug-of-war: executives chasing empire, shareholders begging for discipline.

Meanwhile, CMA shows the ceiling. Maybe HoldCo sparked the sale, maybe they didn’t. Either way, a 14% pop from $70 to $80 is not portfolio-shifting for a $1B fund. And at 155% of TBV for a 10% ROTCE, upside caps fast. Banks do not re-rate like tech. You’re not selling investors on 2–3x book multiples for modest returns.

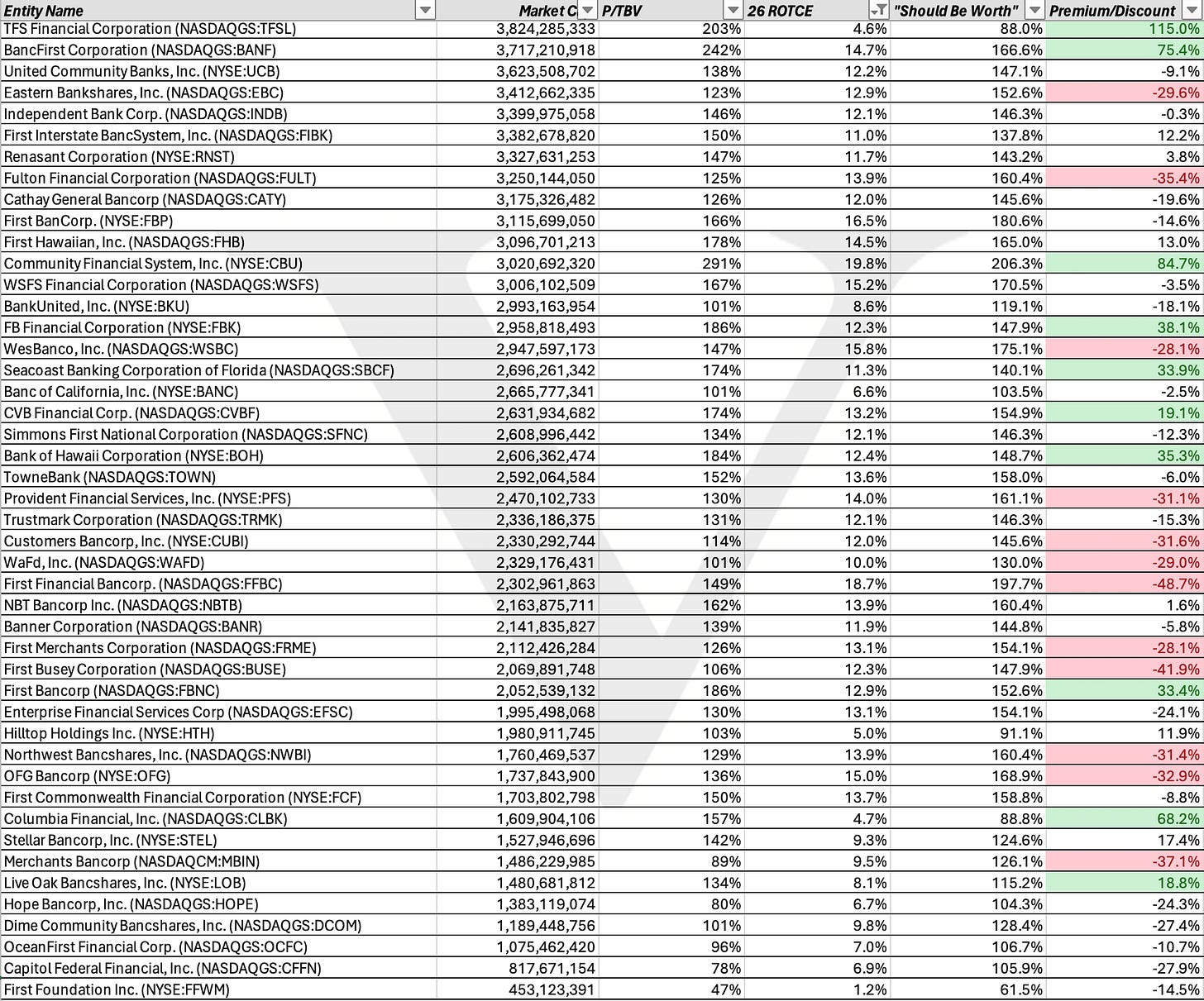

Look at the bottom 20% by implied valuation: EBC, FULT, WAFD, FFBC, NBTB, MBIN, CUBI. All look cheap. All have baggage.

I covered COLB and several of the other major under-earners in more detail in my November bank screen, where I ranked TBVPS compounders and laggards. It adds helpful context on which names are structurally cheap versus which ones are simply digesting acquisitions.

Why Some Banks Stay Expensive Forever

This leads to the second big idea: valuation persistence.

Banks like JPM, GBCI, and CBU earn premiums for one simple reason: they have proved they can manage through every cycle. Management quality compounds trust. Trust compounds valuation.

Regulators use CAMELS: capital, assets, management, earnings, liquidity, sensitivity. But everyone quietly adds a T: trust.

The market knows which executives understand risk in real time, and which simply ride the wave. That’s the gap between a 1.4x TBV multiple and 0.8x.

Why Activists Struggle With Bad Banks

Bad banks tend to stay bad. Poor allocators avoid selling because acknowledging reality threatens their jobs. As Upton Sinclair famously said: “It’s difficult to get a man to understand something when his salary depends on his not understanding it.”

Everyone in banking has lived this story.

And it gets worse below mid-cap levels. The Wall Street Journal has noted that ownership often fragments across family trusts, retirees, and locals who collect dividend checks like clockwork. They are not selling. You can send them an offer, and they’ll file it next to the church bulletin.

This is small-bank activism, illiquid, stubborn, slow, and unrewarding. It keeps valuations cheap permanently. Activists cannot fix that.

But it does create opportunity. You often see $200M market cap banks producing JPM-like ROTCE yet trading at 125% of TBV. To those banks, the message is simple: keep compounding, buy back undervalued shares, and signal confidence.

The Only Real Defense Against Activism

Earn above your cost of equity. That’s the entire secret.

If the S&P returns 10% annually and your ROTCE is below that, you’re underperforming the opportunity cost. When peers compound TBVPS at 8–10% and you brag about 4%, you’re telling the market exactly what you are.

Investors have choices. If I can earn 30% annualized somewhere else, why hold your 10% bank?

Over time, as shareholders age and stock passes to heirs who don’t know the bank, tolerance for underperformance collapses.

Closing Thoughts: Performance Always Wins

I have no issue with HoldCo or activism more broadly. It’s a tough, narrow, messy game. They are at least pushing for smarter capital allocation. I may disagree on tactics or timing, but trying to improve a system is never something I’ll criticize.

At the end of the day, though, returns speak louder than activists ever could. If your ROTCE and valuation are weak and you keep chasing vanity M&A, you don’t need an activist to tell you you’re failing; the market already is.

After watching this cycle for years, I’ve learned to invest in discipline, integrity, and real compounding. Some stocks and some people are simply not worth the hassle. Humans rarely change, especially when someone is shouting at them.

Bank investing is not about deposits or spreads, or capital ratios. It’s about people. It’s about trust. And when management shows you who they are, the first time, you should believe them.

The best is ahead,

Victaurs