ADBE Isn't The Walking Dead

Analyzing the disconnect between ADBE's fundamentals, it's current "terminal" valuation, why it won't be an AI zero, and the risk/reward trade-off for investors today.

There is a specific kind of mockery in the stock market that usually marks a bottom. In late 2025, Adobe isn’t just “down”, it’s being dunked on, and quite well I might add. It has become the punchline of the tech sector: the “Boomer SaaS” company, the “Walking Dead” of AI, the desperate incumbent that tried to burn $20 billion on Figma just to survive.

To the average momentum trader, Adobe is toxic and untouchable.

But to me, this specific kind of sentiment, total apathy combined with a monopoly-like moat, is one of the most exciting signals in finance. When the market leaves a company with 88% gross margins and double-digit growth for dead, it usually creates a mispricing of big proportions.

The risk, of course, is real and to me, the danger is permanent investor apathy. The market might simply fall out of love forever, leaving Adobe to become the next IBM, a profitable zombie that grinds sideways for a decade. This is the “value trap” scenario that keeps investors up at night.

This piece is about looking past the mockery to see if the “Terminal Decline” narrative holds weight, or if we are staring at a massive “Phase 3” AI winner disguised as a disrupted victim that people love to dunk on.

The FIGMA Scar & Narrative Break Downslide

The stock has collapsed lately because the story broke, even while the core business technically held the line. This narrative degradation happened in four distinct phases, each compounding the damage to the multiple.

The first crack in the foundation was the “Figma Scar.” When Adobe bid roughly $20 billion for Figma in 2022, the market gasped at the 50x ARR multiple. When regulators eventually killed the deal in December 2023, forcing Adobe to pay a $1 billion breakup fee, investors interpreted the move as a confession. The prevailing view was that Adobe knew it had missed the future app design shift and was acting out of desperation. That they couldn’t innovate & had to resort to M&A to fill EPS growth and innovation gaps. And that narrative scar hasn’t healed.

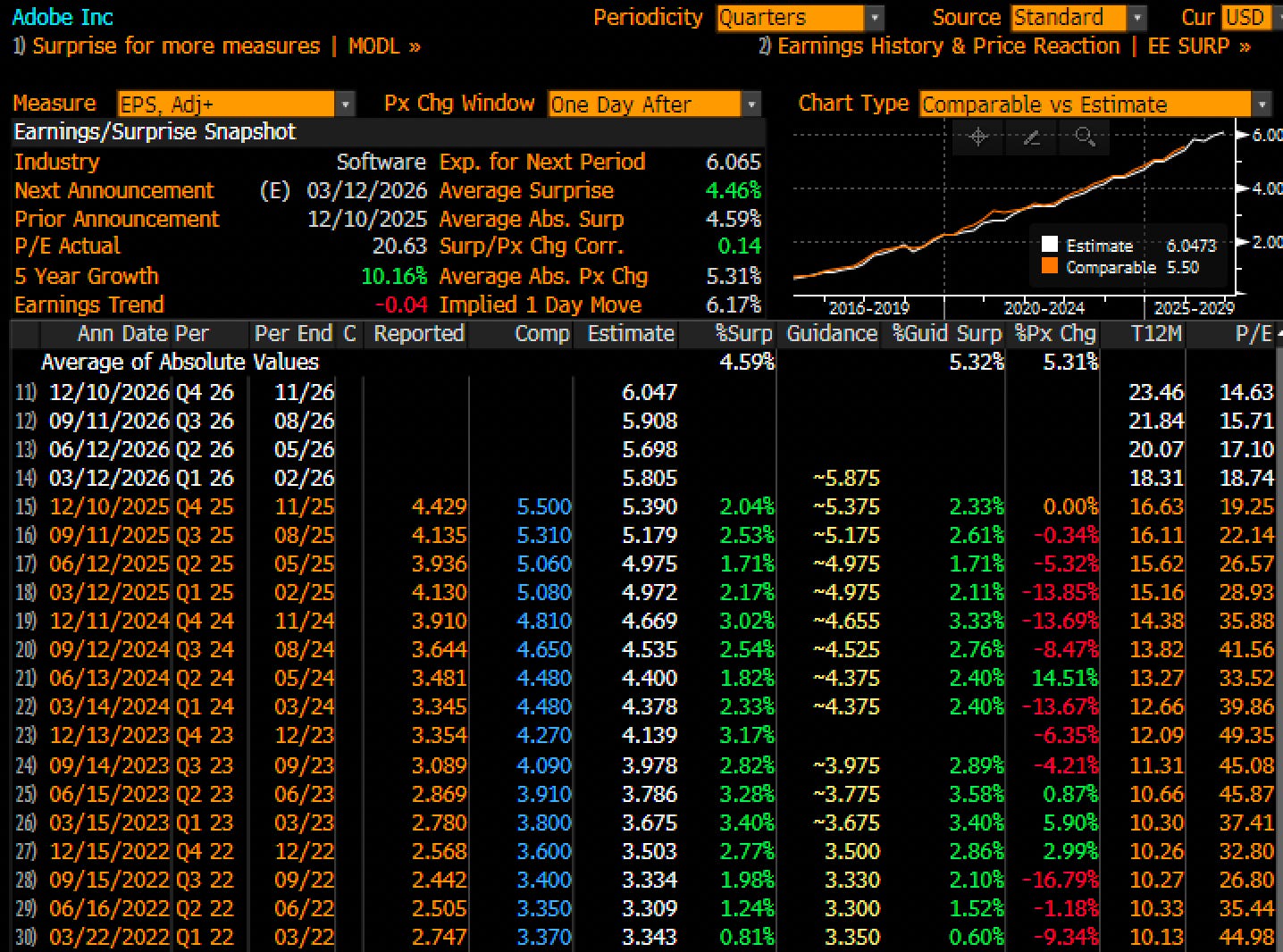

This was immediately followed by an expectation trap. People thought ADBE would grow. Throughout 2024 and 2025, Wall Street modeled some AI (and FIGMA) gains, with analysts whispering about a re-acceleration in EPS. But instead, Adobe printed steady, boring growth and the multiple collapsed with the Q4 of ‘24 report starting the real slide. $3.91 on expectations of $4.53 followed by a couple quarters later another $3.93 on expectations of $4.97.

Then came the vibe gap between “cool” and “useful.” While OpenAI’s Sora and Midjourney were generating viral videos on X (that everyone has since forgotten about I might add)Adobe was busy building boring, enterprise-safe and high quality workflows. The market and the meme stock investors chased the shiny object, and the narrative drifted from Adobe being a “Compounder” to a “Legacy Incumbent” incapable of innovation. This is the shift from 30-40x P/E multiples to the mid-teens it has right now.

Finally, there is the Canva shadow which is the elephant in the room, and one I think is real. The market is terrified of Canva’s massive valuation and its looming 2026 IPO. The real fear is Canva’s ambition; with its acquisitions of Affinity and Leonardo.ai, it is signaling a move upmarket to attack Adobe’s pro user base just as Adobe tries to move down. With over 220 million monthly active the looming IPO sucks all the “next new thing” oxygen out of the room. And as you all know from my writings, people love the next hot IPO even though they often end in investors holding the bags.

But the real qustion is should you buy ADBE here. The answer starts with the whole narrative break going on and it’s why I think most tourists are missing it.