Straight Outta Sweden: Klarna’s $45B Hype, Its $7B Bottom, and the $14B IPO Test For Investors Today

Here we go again, another day and another IPO coming out hot in the fintech space. You can say a lot of things about fintechs and you can love ‘em or hate ‘em, but they are unbelievably good at sensing when the capital markets windows are open. At sniffing out the animal spirits if you will. So when they see that the market’s have gone from “it’s so over” to “we’re so back” and even up into the realms of “holy $hit, Chamath is SPAC’ing again” you know you’re about to see an IPO boom.

And the latest one hitting the newswires is Klarna, the Swedish-born fintech founded in Stockholm in 2005 that turned the ratchet old check out process of paying all your money up front into a smooth and flexible “buy now pay later” model. Shoppers love it. Merchants love it. But is this business model supportive of durable growth and margin expansion, or is it just another IPO to dump shares on retail bagholders.

Klarna’s mission is, like most fintechs, ambitious yet simple: help people save time, money, and reduce financial stress while helping merchants grow. And while they call themselves a “personalized, trusted assistant” what that means for us financial insiders is that they’d like to be the place you go to buy things. They offer BNPL with merchants paying the take rate so customers can get things interest free and spend more money at checkout. They offer “fair financing” which is basically just higher yield more credit card like offers. And they’re also building out an ecosystem around the payments rails including a card, savings accounts, loyalty features, and interestingly an ad network.

This IPO comes just after Affirm posted blow out revenue numbers, which I wrote up recently, and has ripped back to local highs after being left for dead in 2022 & 2023. So the question for you as investors is …

Should I buy this IPO?

Is the hype worth it?

Or should I wait to fade it like Victaurs said to on CRCL & CHYM?

And for that you’ll have to drop in behind the paywall.

The scale of Klarna is pretty impressive and the first thing to know for Klarna is this network. They have roughly 93 million active customers and 675k merchants across the globe and are projected to hit 111 million and 790k by the time they IPO. Over 44% of the top 100 retailers in each major market are on their platform: H&M, Zara, Coach and Sephora for example. They’ve helped create a category where there once was none in Buy Now, Pay Later.

At the scale they’ve reached this network becomes a self-reinforcing moat. More consumers use the app and payments options, they spend more money, and more merchants are incentivized to integrate Klarna to get a piece of your higher spend. Every payments company begins life looking fragile. The margins are thin, the competitors are everywhere, and the switching costs are low. But history shows that what looks fragile at the micro can become unbreakable at the macro once trust and repetition set in. Visa and Mastercard were once just rails; today they are irreplaceable networks. Klarna is betting it can walk the same path.

To be fair, they’ve built a network that operates in North America & Europe with plans for further and further global expansion. On top of this they’ve partnered with the payments gateways like Worldpay, Stripe, and Adyen as well as the digital wallets like Apple & Google Pay, in effect embedding itself at every checkout possible. Which in plain speak means they don’t need people to open their app to see and choose Klarna for payments. And from a volume standpoint, their base is broad with no single merchant accounting for more than 10% of volume. Visa & Mastercard have successfully accomplished what Klarna is trying to do now: create a durable network payments ecosystem that can compound for years. You capture eyeballs and wallets via a new technology or product, and leverage that into a means to expand your margins by adding new products or services, and grow your Gross Merchandise Volume (GMV) by leveraging data on your customers habits. The moat becomes the habits of your customers and merchants.

While their vision is admirable, many companies in the fintech space are trying to execute some version of this strategy. So before you get too excited about KLAR, you really have to understand their numbers.

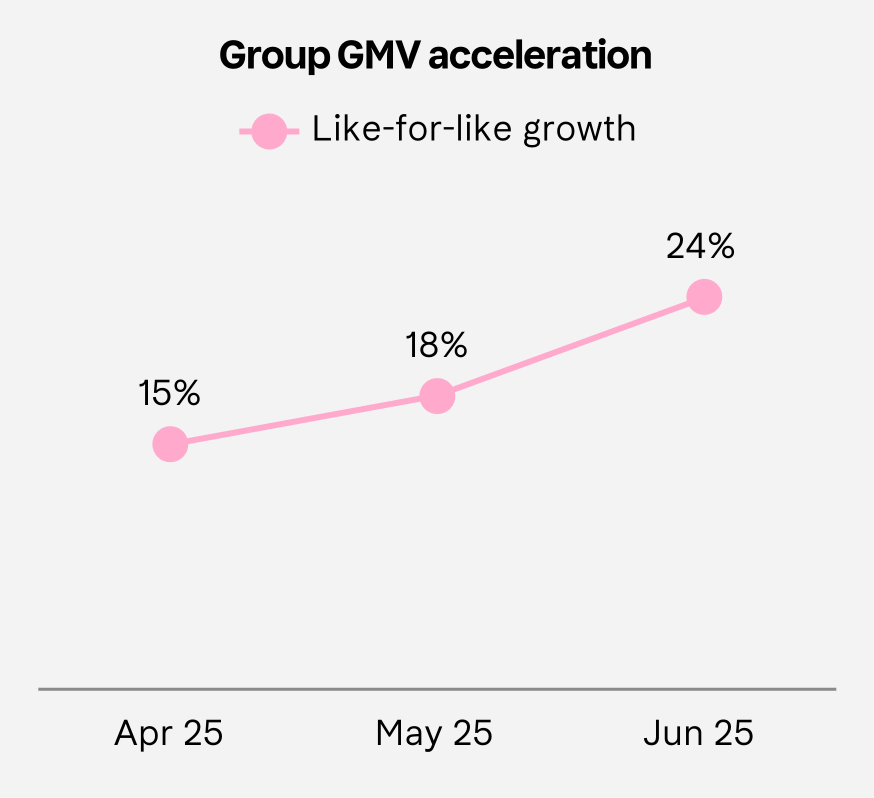

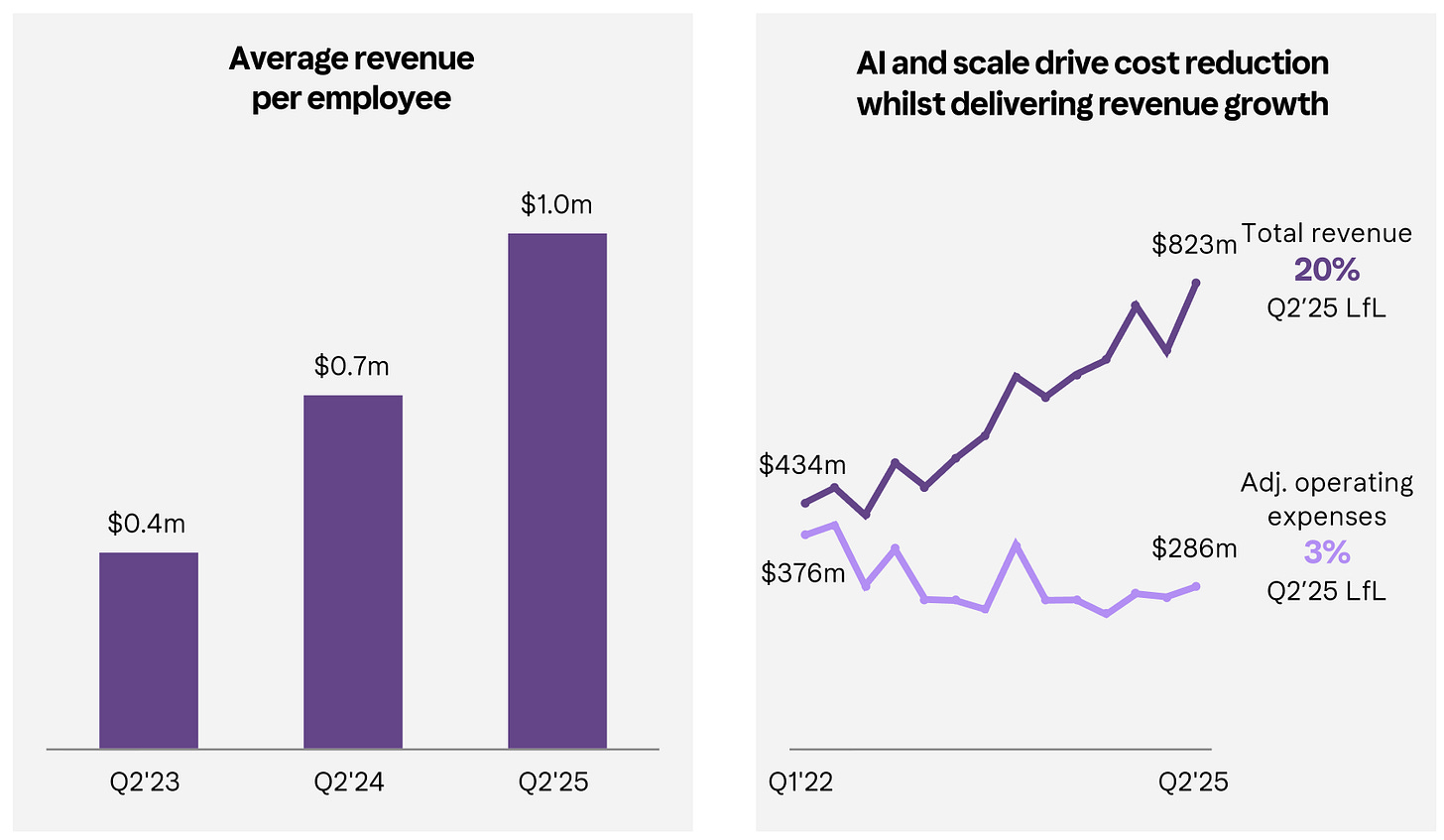

For Klarna they have a pretty good financial track record, which is inflecting and giving investors the potential “profitable growth” vibe needed to IPO. In 2024, Klarna did $2.8 billion in revenue (up 24% YoY) while cutting it’s operating loss to $121 million which is a 63% improvement from ‘23’s loss and down nearly $1 billion from the loss in 2022. They posted an ever so small and symbolic net profit of $21 million in 2024 which matters only in so far that it’s not technically “losing money”. But a peek under the hood on their take rate shows the main difference between Klarna and their main competitor in the space, Affirm. Affirm has a relatively fat margin, and Klarna’s is thin to begin with. Q2 of ‘25 numbers show $823 million of revenue on GMV that quarter of $34 billion which is 2.4%. Affirm by comparison runs closer to 4%. Credit for Klarna though is a strong point at just under 50bps of GMV compared to the 3% to 4% loss rates for typical consumer lending. So to summarize, credit quality is strong but Klarna definitely exists on a much thinner margin that Affirm.

Investors often obsess over margins in the short term, but the real edge comes from scale economics shared widely across an ecosystem. Amazon lived on thin margins for decades while building layers of logistics, cloud, and ads that became cash machines. Klarna is sketching the same playbook in fintech, survive on thin take rates until the ecosystem itself becomes the moat.

I’d also say that their revenue mix is diversified with 24% of total coming from interest income which benefits from their customer savings accounts and time as a bank. They are super efficient. Which basically means they run a tech company first, not a bank first, although they act and make money like a bank. They frequently tout revenue per employee which is up to $821k in ‘24 up from $344k in 2022. This is the secret to success of a lot of great fintechs, like Nubank which I’ve written about. Create your platform based on a beautiful UX with a robust tech stack, and then use the BNPL product to grow customers at low costs. Lather, rinse, repeat. The $14 billion in deposits which produces low cost deposits is also a bit of a structural advantage relative to other payments companies like Affirm.

The novel item in Klarna’s strategic model is advertising, and this is more than a side hustle. It’s a future margin lever. Klarna already processes billions in payments at razor-thin economics, so the ad network is how they’ll plan to turn volume into high-margin dollars. Merchants now buy sponsored placements, search, and campaigns inside Klarna’s app, powered by SKU-level data on what people actually browse and buy. That revenue has already grown from $13 million in 2020 to $180 million in 2024, small today but proof of concept. If it scales, ads could become the same kind of hidden profit engine for Klarna that retail media has become for Amazon and Walmart.

Before I move onto the last big thing, I need to be explicit about growth. When you choose to buy a “hot new growth machine fintech” IPO like KLAR you do need to think objectively about whether or not they’re growing enough to justify the inflated IPO expectations. For Klarna, revenue YoY has grown about 17% on GMV growth of 19%. But compare that to Affirm who has seen revenue growth of 40% YoY on GMV growth of 35%. Not exactly lighting the world on fire, which tempers my desires to buy the IPO despite thinking the company is a good one.

The last thing for me with any stock is the management team. And their CEO Sebastian Siemiatkowski has led the company for 20 years taking it from a tiny company into a true brand and new category. To this extent, management does have the integrity I look for. Do they go a little too evangelist at time, yes. But they’ve managed through massive losses and a big wave of cost cutting after the 2021 excess. They also are AI forward in their actions, not just their words. Allegedly, 96% of Klarna employees use generative AI in their daily work and 85% of engineers have an AI coding copilot. They’ve also launched an AI-driven shopping feed and discovery engine to personalize recommendations. The data they are generating in the process becomes an even bigger competitive asset.

Dare I say they’re actually executing on their grand vision to become for Gen-Z what Amazon & Visa is for the boomers. The one stop habitual places they go to spend money. So management deserves major kudos for running a product creating company in multiple countries, and executing at scale. But again this doesn’t mean you have to push buy on an 8x oversubscribed IPO, which is what we may get.

If I had to put a point on the bear case it’s as follows. The margins are too thin even after cost cuts and AI efficiencies. It’s inherently volume-heavy/low take-rate and dependent on the merchant fees. This makes it marginally more cyclical next to other fintechs, since they need more and more volume at thin margins just to keep the wheels spinning. Like Affirm, they’re also susceptible to competition from the Apple Pays or the PayPals of the world creating functionally the same BNPL checkout options. Also, consumers themselves have very low switching costs. You can literally just switch to a new form of BNPL to pay or just use a regular credit card. And if I’m nitpicking, the “super-app” vision does risk spreading strategic energy too thin. They’re a bank, a payments network, a credit provider, and also an ad platform. Executing across all these fronts could lead to becoming a jack of all trades, and master of none. Make no mistake the majority of their revenue is made from merchants who pay Klarna to boost GMV, but over time they’ll have to find a way to diversify into fatter margin services type revenue streams.

And now for the million dollar question, the valuation one. And in that spirit, should you buy it?

Well first, keep in mind that in 2021 Klarna did a $639 million round led by none other than SoftBank with a post-money valuation of $46 billion. At the time, I believe that revenue for the full year was $1.4 billion. An absolutely comical multiple of 32x revenue paid by Masa Son, which was followed up in 2022 by a $6.7 billion valuation down round.

Today, people are talking about a $14 or $15 billion valuation for the IPO which my math puts it around 4.5x Q2’s $823 million annualized revenue. They’re seeking to raise north of $1 billion through 34 million shares in this offering, with both the company and insiders selling shares. I read that 5 or 6 million shares are newly issued and the remaining 28 million shares being sold are from existing investors cashing out. Which my dear friends mean that this is exit liquidity for the insiders, not that there’s anything wrong with that. This wall of shares for sale couple with the prior mega peak valuations and 2022 down round, could serve as a soft ceiling for whatever post pop price this gets to.

Just run the math to see if you want to own this.

At their current take rates, to make Klarna look cheap (2x or 3x revenue) you’d need something like $180 to $220 billion in GMV which would require Klarna to grow another $60 to $100 billion (50% more to 80% more) in GMV. Could this happen in the future? Yes, absolutely. But the key is always when and how much are you paying for this growth.

If this IPO’s at 5x revenue maybe … maybe it’s fair. But it’s likely overvalued. And assuming there’s the standard fintech pop that CHYM and CRCL got where people were in a frenzy to snag shares of “the next new thing” on their Robinhood app, then you can assume I’ll be looking for ways to short it. In the long-run, maybe they’re able to create thicker margins through services, but for now they’re in a knife fight with AFRM and every other new BNPL provider for GMV dollars. Which means you do not need to be chasing anything out of the shoots like the uninformed masses.

Klarna is fascinating because it’s not just a BNPL shop trying to squeeze a living out of thin take rates. It’s building a multi-sided ecosystem where the same network that moves transactions also generates ad clicks, finances longer-term loans, and locks in sticky deposits. That looks fragile on the surface, but with scale it compounds: every new consumer or merchant doesn’t just add volume, they deepen the flywheel across three or four revenue lines. Over time, the checkout button can become a data engine, the data engine a marketing channel, and the marketing channel a lending funnel. That’s the dream.

The problem is the dream costs money, and Klarna is still running on razor-thin margins in a brutally competitive space. At ~$14B, investors are being asked to pay ~5x revenue for a business that hasn’t proven it can translate volume into durable profitability. The network is wide, but the moat is shallow, and insiders are already using this IPO as an exit ramp. If Klarna does eventually pull off its transformation into a platform, today’s price may look fair in hindsight, but the odds of that happening without more pain first are low. For me, this IPO feels less like a fresh opportunity and more like a liquidity event dressed up as innovation.

Until next time,

Victaurs

Great work as always, pleasure to read.